62

63

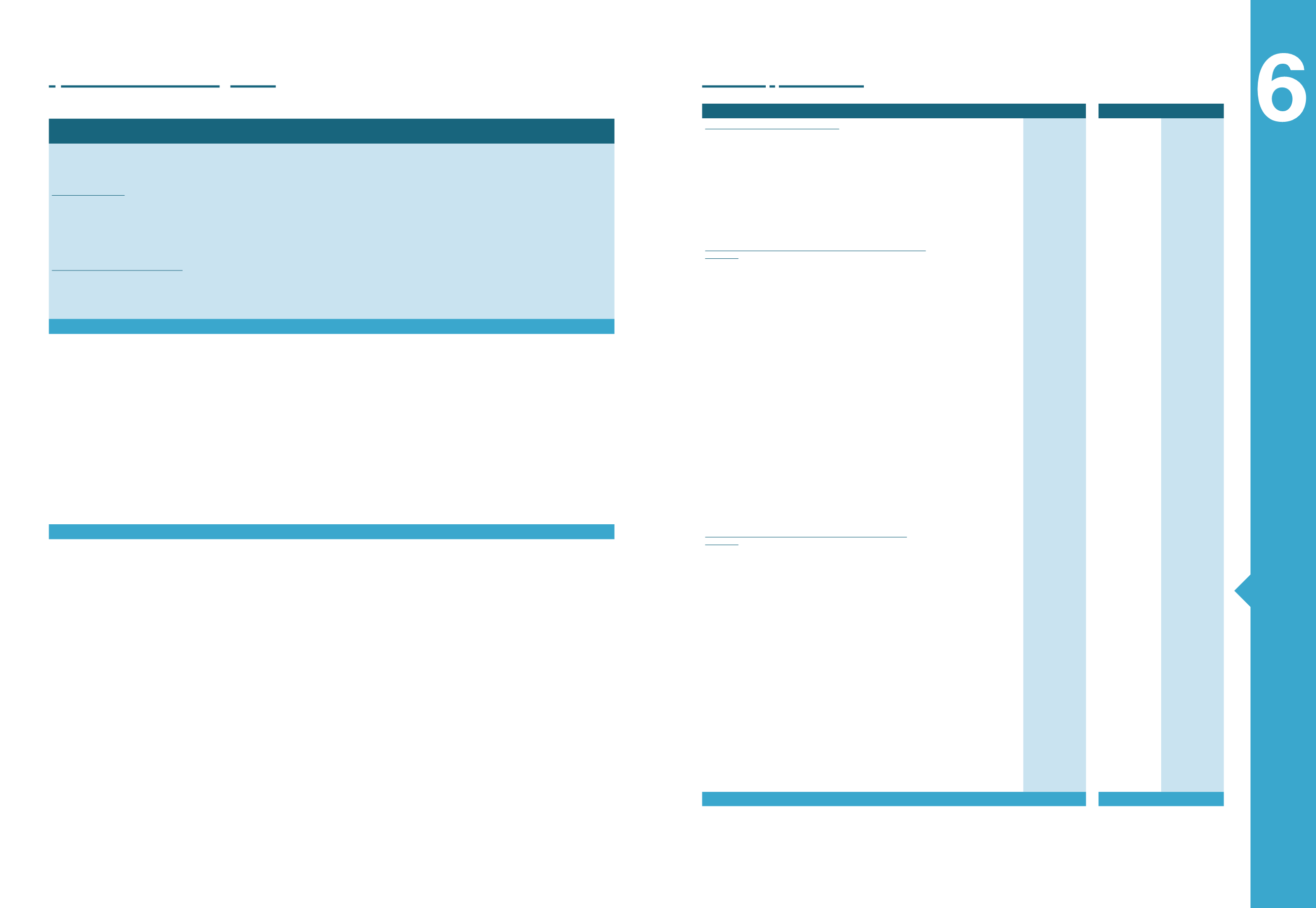

Annual Financial Statements

MYTILINEOS S.A.

(Amounts in thousands

€

)

Share capital

Share

premium

Other

reserves

Retained

earnings

Total

Opening Balance 1st January 2014, according to IFRS -as

published-

125,100

141,585

16,029

221,854

504,568

Change In Equity

Transfer To Reserves

-

-

(29,622)

29,622

-

Impact From Merge Through Acquisition Of Subsidiary

-

-

17,129

(23,147)

(6,018)

Transactions With Owners

-

-

(12,494)

6,476

(6,018)

Net Profit/(Loss) For The Period

-

-

-

(2,224)

(2,224)

Other Comprehensive Income:

Deferred Tax From Actuarial Gain / (Losses)

-

-

19

-

19

Actuarial Gain / (Losses)

-

-

(68)

-

(68)

Total Comprehensive Income For The Period

-

-

(49)

(2,224)

(2,273)

Closing Balance 31/12/2014

125,100

141,585

3,486

226,106

496,277

Opening Balance 1st January 2015, according to IFRS -as

published-

125,100

141,585

3,486

226,106

496,277

Change In Equity

Increase / (Decrease) Of Share Capital

(11,692)

-

-

-

(11,692)

Transactions With Owners

(11,692)

-

-

-

(11,692)

Net Profit/(Loss) For The Period

-

-

-

(271)

(271)

Other Comprehensive Income:

Deferred Tax From Actuarial Gain / (Losses)

-

-

(4)

-

(4)

Actuarial Gain / (Losses)

-

-

14

-

14

Total Comprehensive Income For The Period

-

-

10

(271)

(261)

Closing Balance 31/12/2015

113,408

141,585

3,496

225,835

484,324

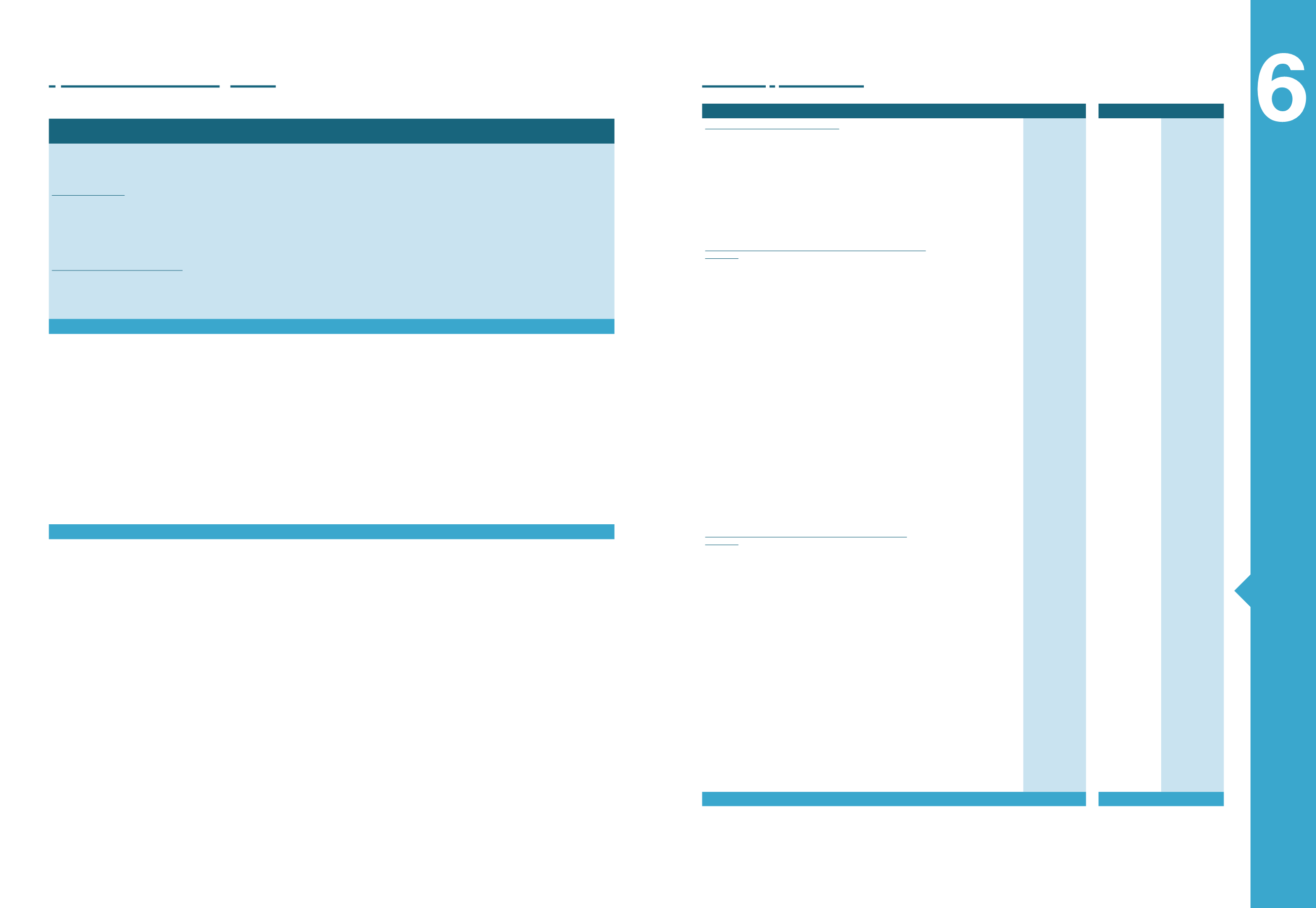

(Amounts in thousands

€

)

1/1-31/12/2015 1/1-31/12/2014 1/1-31/12/2015 1/1-31/12/2014

Cash flows from operating activities

-

Cash flows from operating activities

4.24

(9,360)

239,878

(4,837)

3,384

Interest paid

(50,752)

(54,285)

(10,377)

(13,586)

Taxes paid

(20,824)

(14,353)

(760)

0

Net Cash flows continuing operating activities

(80,936)

171,240

(15,974)

(10,202)

Net Cash flows discontinuing operating activities

(4,237)

(181)

-

-

Net Cash flows from continuing and discontinuing operating

activities

(85,173)

171,059

(15,974)

(10,202)

Net Cash flow from continuing and discontinuing investing

activities

-

Purchases of tangible assets

(41,539)

(49,448)

(134)

(49)

Purchases of intangible assets

(3,342)

(5,140)

(29)

(34)

Sale of tangible assets

282

7,466

-

15

Dividends received

160

4

16,080

7,796

Purchase of financial assets held-for-sale

(108)

-

-

-

Purchase of financial assets at fair value through profit and loss

(6,832)

(18,676)

-

-

Acquisition of associates

(2,450)

(6)

-

-

Acquisition /Sale of subsidiaries (less cash)

(2)

(1,473)

-

(288)

Sale of financial assets held-for-sale

-

5

-

-

Sale of financial assets at fair value through profit and loss

4,660

21,529

540

-

Interest received

1,825

5,157

3

102

Grants received

599

-

-

-

Other cash flows from investing activities

1

24

-

-

Return of Capital from Subsidiary

-

-

157,600

-

Net Cash flow from continuing investing activities

(46,745)

(40,558)

174,060

7,543

Net Cash flow from discontinuing investing activities

-

-

-

-

Net Cash flow from continuing and discontinuing investing

activities

(46,745)

(40,557)

174,060

7,543

Net Cash flow continuing and discontinuing financing

activities

-

Tax payments

(3)

(37)

-

-

Dividends payed to parent's shareholders

(13,787)

(7,965)

-

-

Proceeds from borrowings

295,593

187,296

13,190

-

Repayments of borrowings

(251,000)

(186,159)

(159,122)

-

Return of share capital to shareholders

(11,702)

-

(11,692)

-

Net Cash flow continuing financing activities

19,100

(6,865)

(157,623)

-

Net Cash flow from discontinuing financing activities

-

-

-

-

Net Cash flow continuing and discontinuing financing

activities

19,100

(6,865)

(157,623)

-

Net (decrease)/increase in cash and cash equivalents

(112,817)

123,636

462

(2,659)

Cash and cash equivalents at beginning of period

313,428

181,770

786

3,443

Less: Cash and cash equivalents at beginning of period from

discontinuing activity

-

-

-

-

Exchange differences in cash and cash equivalents

249

8,022

-

3

Net cash at the end of the period

200,859

313,428

1,249

786

Cash and cash equivalent

200,859

313,428

1,249

786

Net cash at the end of the period

200,859

313,428

1,249

786

Statement of changes in Equity (Company)

The notes on pages 56 to 123 are an integral part of these financial statements

Cash flow statement

The notes on pages 56 to 123 are an integral part of these financial statements