27

26

The two Gas Fired power plants of Protergia Group, one in Saint Nico-

las Viotia of the subsidiary PROTERGIA AGIOS NIKOLAOS POWER

SA and in Agioi Theodoroi Corinthian of the subsidiary «KORINTHOS

POWER», had a satisfactory operation – given the circumstances of

the market- during 2014, despite the negative impact of the above

mentioned changes in the regulatory framework. The total genera-

tion of the two power plants reached 778 GWh compared to 2.990

GWh in 2013. In addition, the Renewable Energy Sources (RES) of the

Group had also a satisfactory operation with their electricity genera-

tion reaching 91,56 GWh for 2014 as compared to 107,4 GWh in 2013.

Said decrease of the generation output is mainly due to the remark-

ably reduced wind intensity in 2014.

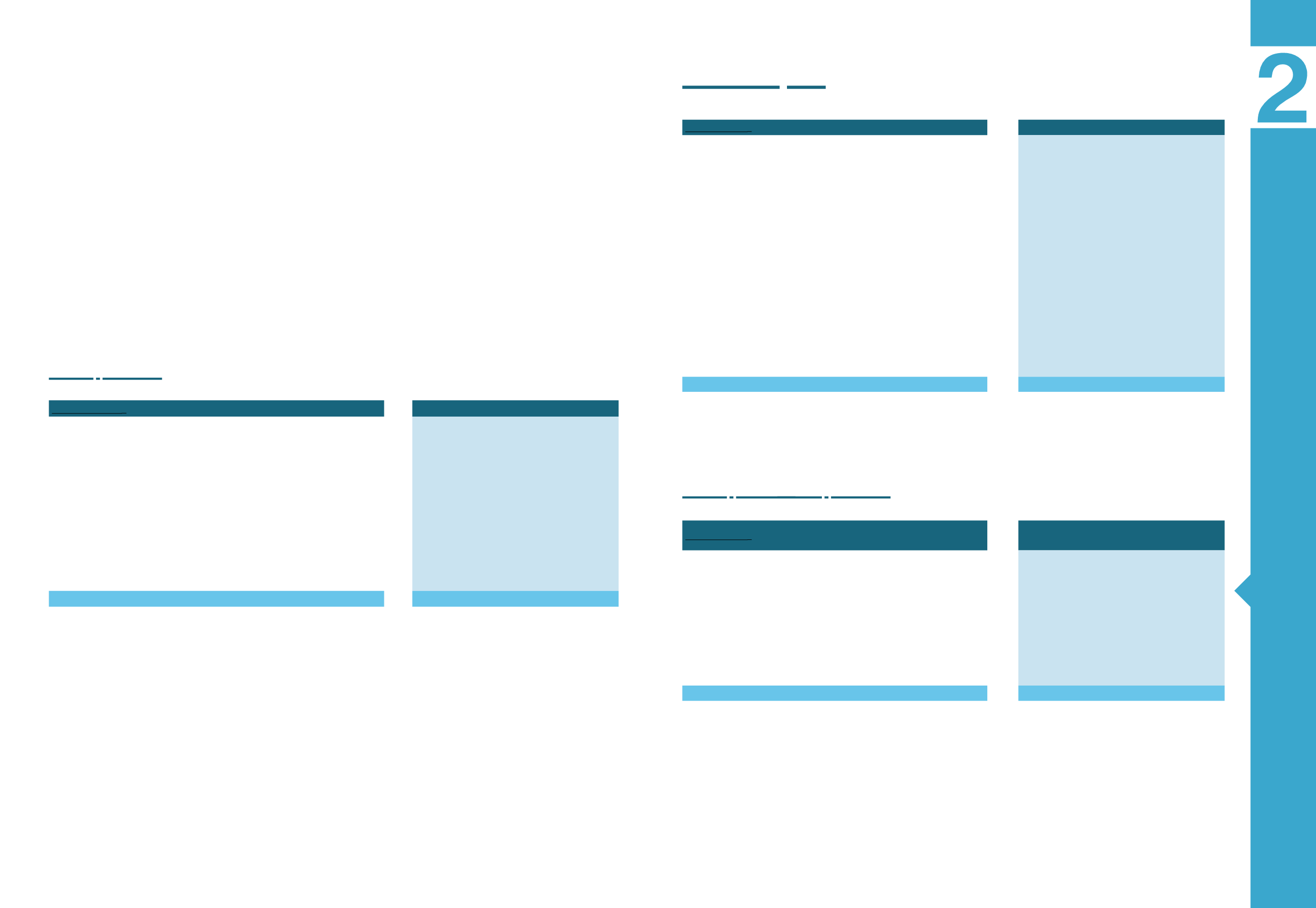

Amounts in mil.

€

Variance Analysis

Turnover 2013

1,403.0

Effect from:

Organic $/

€

eff.

-1.8

Volumes

-0.9

Premia & Prices

17.1

LME

-7.8

Other

0.0

Energy

-201.6

Zn-Pb discontinued operation

-1.4

EPC

-2.3

LNG Trading

28.4

Turnover 2014

1,232.6

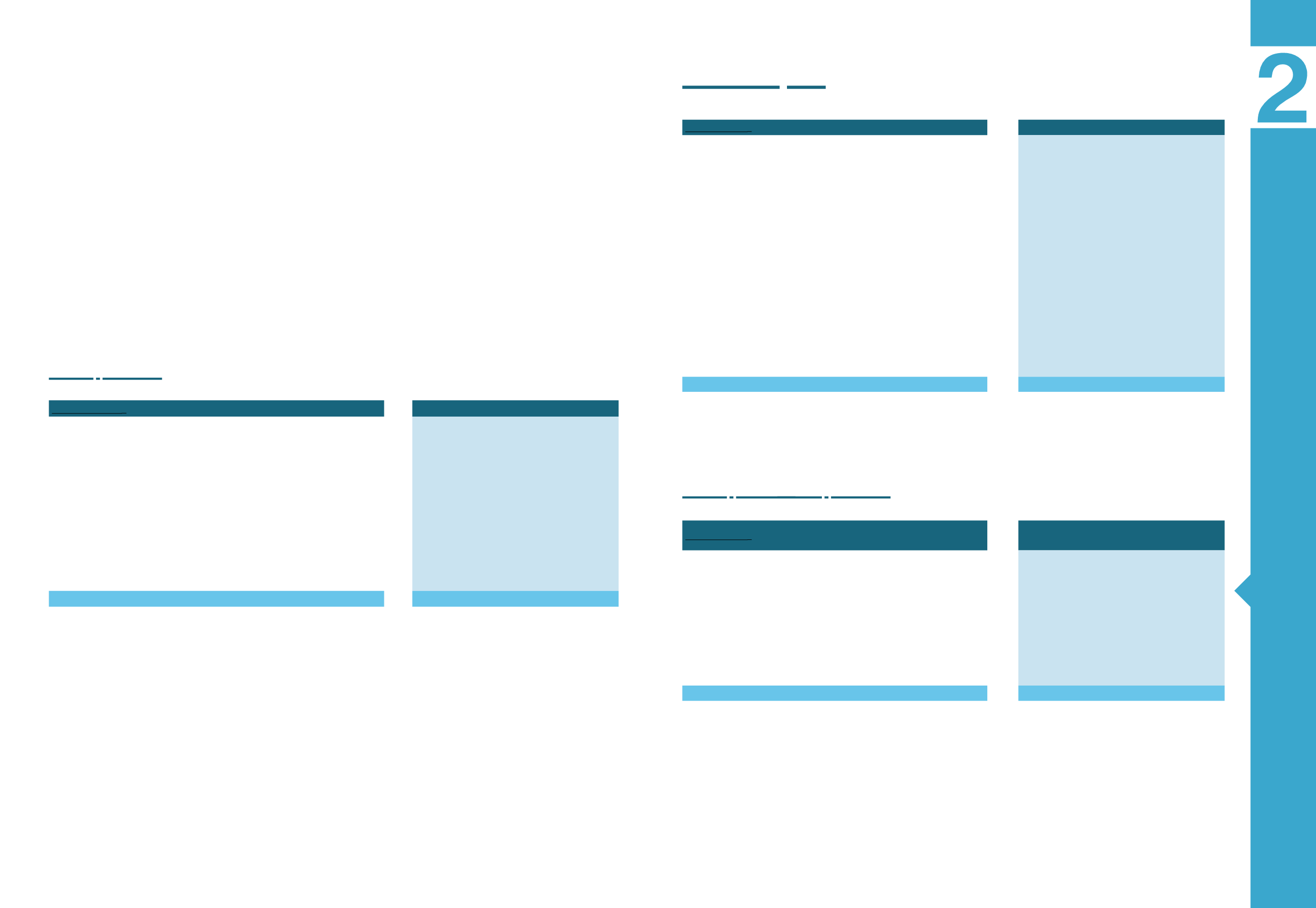

Amounts in mil.

€

Variance Analysis

EBITDA 2013*

225.3

Effect from:

Organic $/

€

eff.

-1.7

Fuel Oil + NG + Steam

35.6

LNG

0.5

Volumes

-1.4

Premia & Prices

18.1

Opex & R/M

14.8

Metallurgy (One offs)

-16.4

LME

-7.8

EPC

2.2

EPC one off

0.0

Electricity

3.6

Other

-4.5

Energy Sector

-14.8

Zn-Pb discontinued operation

0.3

EBITDA 2014

253.9

Regarding the development plan for new

RES projects, it is noted that Protergia

Group had, in 31/12/2014, a total of 62,6MW

of Wind Farms under construction. Further

to that, the pipeline of RES projects under

several stages of licensing process amount

approximately 1.000 MW.

In respect of cross border electricity trad-

ing Protergia Group, though its respec-

tive subsidiaries, traded a total quantity of

189,4GWh, 311% up as compared to 2013.

In particular, the effect to the Group’s turn-

over as well as operational and net profit-

ability during 2014 compared to the previ-

ous fiscal year are the following:

Amounts in mil.

€

Variance Analysis

Net Profit after Minorities 2013

15.9

Effect from:

Operating Results (EBIT)

37.6

One - off Financial results

0.0

Net Financials

10.3

Share in Associates Results

14.7

Minorities

-3.9

Discontinued Operations

-0.1

Taxes

-9.6

Net Profit after Minorities 2014

64.9

C. Net Profit after minorities

Α. SALES

Β. EBITDA

EBITDA 2013* : EBITDA figure as at 31/12/2013 is adjusted (note 3.9)

BOARD OF DIRECTORS ANNUAL REPORT