industry sector. During last year, ALUMINIUM OF GREECE

also made a number of moves that paved the way for its further

growth and for enhancing its social footprint, and are expected to

consolidate its position as the largest vertically integrated alumina

and aluminium plant in Europe.

In the Energy Sector, Protergia, the largest independent electricity

producer in Greece, is continuing with its investments in modern

power plants, despite the fact that its growth is taking place in

a highly unstable and constantly changing environment for the

country as well as for the energy market. In spite of the difficulties

in the market, in 2014 Protergia entered the retail market for

electricity, aiming to be able to supply electricity very soon

to businesses and households whose number will match its

production capacity, yet in the framework of a liberalised energy

market modelled after those in the other European countries.

Last year, through M&M Gas, MYTILINEOS Group also led

developments in the natural gas sector, as the first independent

supplier to provide natural gas to an industrial consumer.

Financial and business performance are not the only areas where

MYTILINEOS Group is innovating and distinguishing itself. Our

actions and initiatives to create value for the society in which

we live and operate are for us a source of equal, if not greater,

pride. The social product generated by the Group for 2014

stood in excess of

€

261 million, an amount that was allocated

to business, social and environmental investments. Finally the

Group’s Sustainability Report 2013 was certified for compliance

with the requirements of Application Level A+, the top application

level under the GRI-G3.1 Reporting Guidelines.

Throughout the deep recession of the Greek economy and after six

years marked by unprecedented business and financial challenges,

MYTILINEOS Group remains committed to its strategic focus on

markets abroad and to the strict control of costs, which has been the

hallmark of the business model it has been following since 2008. As

a result, in 2014 it posted improved profits and a rapid decline of net

borrowing, while strengthening its international profile through the

increased participation of foreign institutional investors.

Although its activities lie in sectors that were harshly challenged, 2014

was yet another year of sustained positive results for the Group. The

strategy to prepare for and shield itself against the challenges of the

crisis helped the company not only to withstand the recession, but

also to continue to grow and steadily invest, going ahead with new

important business moves during the year.

The impact of these moves was also reflected in the Group’s financial

figures, leading some of the largest players in the global economic

scene to express their confidence in MYTILINEOS Group. Canadian

Fairfax Financial Holdings, one of the most prestigious asset

management companies, opted to continue its investment in the Group

by further increasing its shareholding stake in it. In this way, Fairfax

gave a clear vote of confidence to the Group, enhancing even more

the latter’s value and negotiating power, despite the risks associated

with the Greek economy. Eurobank Equities too was consistently

raising the bar for the MYTILINEOS Group share, by including it in its

top investment picks. Finally, Kepler Chevreux and Wood & Company,

two of the world’s leading international investment firms, expressed

their confidence in the performance of the Group’s share and initiated

their coverage of it.

METKA’s course during 2014 mirrored that of the Group. Drawing on

its strong financial structure, the company was appointed preffered

bidder in the tender procedure for the

€

273 million project of the

new Kiato-Rododafni railway line, in what was a clear statement of its

intention to make a comeback as a strong contender for infrastructure

projects in Greece, bringing to the domestic market its experience and

significant liquidity from its international activities. In parallel, in 2014

METKA continued to implement successfully the contracts it has been

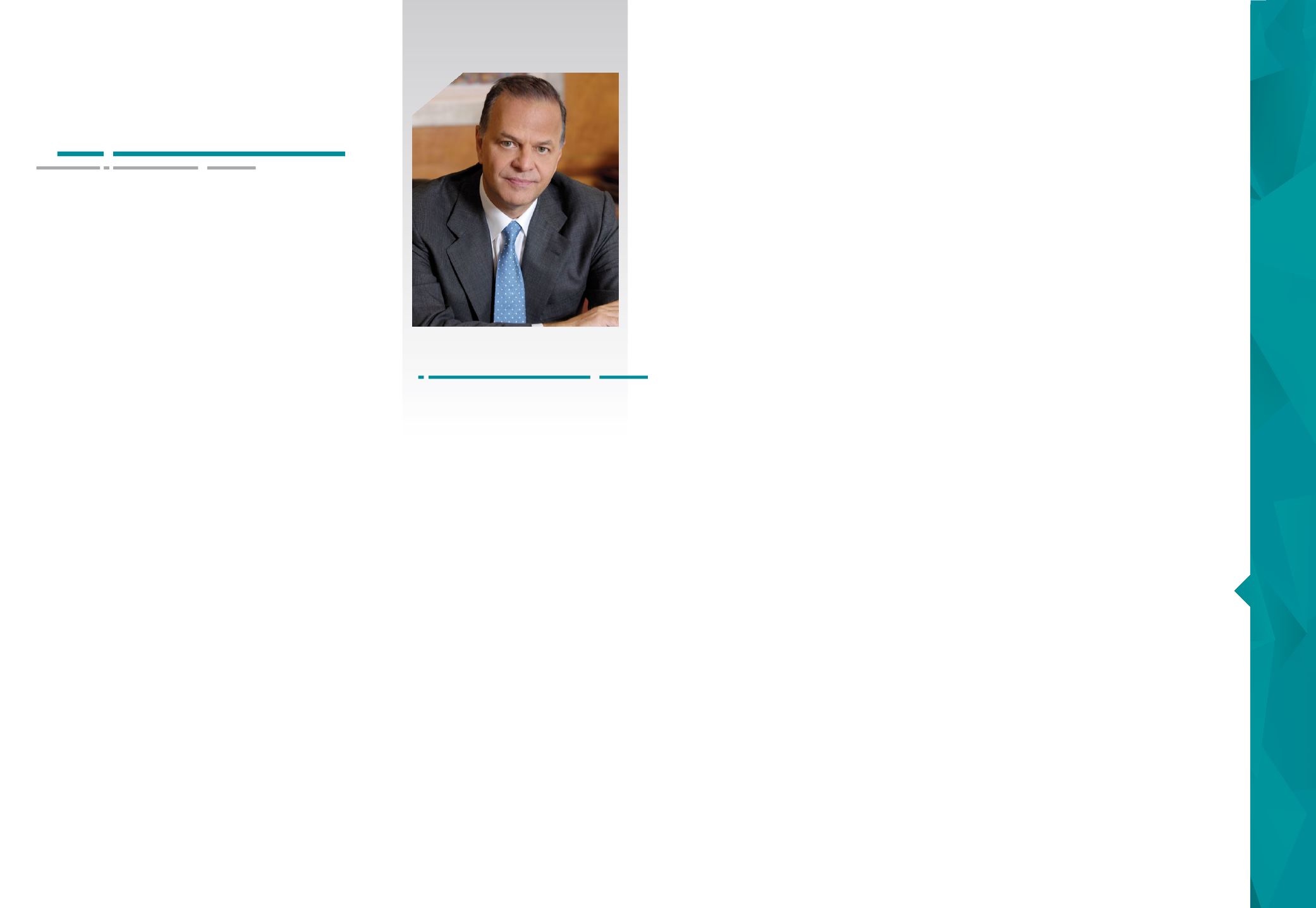

Message from

the Chairman

awarded abroad and managed to deal

effectively with the environment of instability

in the Middle East markets, as it accelerated

the implementation of its projects abroad

and strengthened its position in the global

market for EPC projects in the energy

sector.

For ALUMINIUM OF GREECE, too, 2014

was the first year in which it reaped the

fruits of the “MELLON” programme – the

company’s two-year long effort to curtail

costs and improve its competitiveness.

The “MELLON” programme is the sector’s

most ambitious programme on a global

level. Its successful completion, coupled

with the mid-year recovery of aluminium

prices, enhanced the Sector’s performance

significantly and succeeded in drastically

improving the competitiveness of the

Group’s flagship company in the heavy

Evangelos Mytilineos

Chairman & CEO

Annual Repor t 2014

03

02

ΜΕΤΚΑ,

ALUMINIUM OF

GREECE, Protergia,

M&M Gas.

Four leading

companies, one

Group, a single

strategy. Steady

progress, a

dynamic portfolio,

a vision for

the future.

ΜΕΤΚΑ, ALUMINIUM OF GREECE,

Protergia, M&M Gas. Four leading

companies, one Group, a single

strategy. Steady progress, a dynamic

portfolio, a vision for the future. Our

target for 2015 is to continue firmly on

this path, aiming to achieve growth

for the Group and for the Greek

economy and society, focusing on

our people, our shareholders and

our business partners.

“

”