115

114

Annual Financial Statements

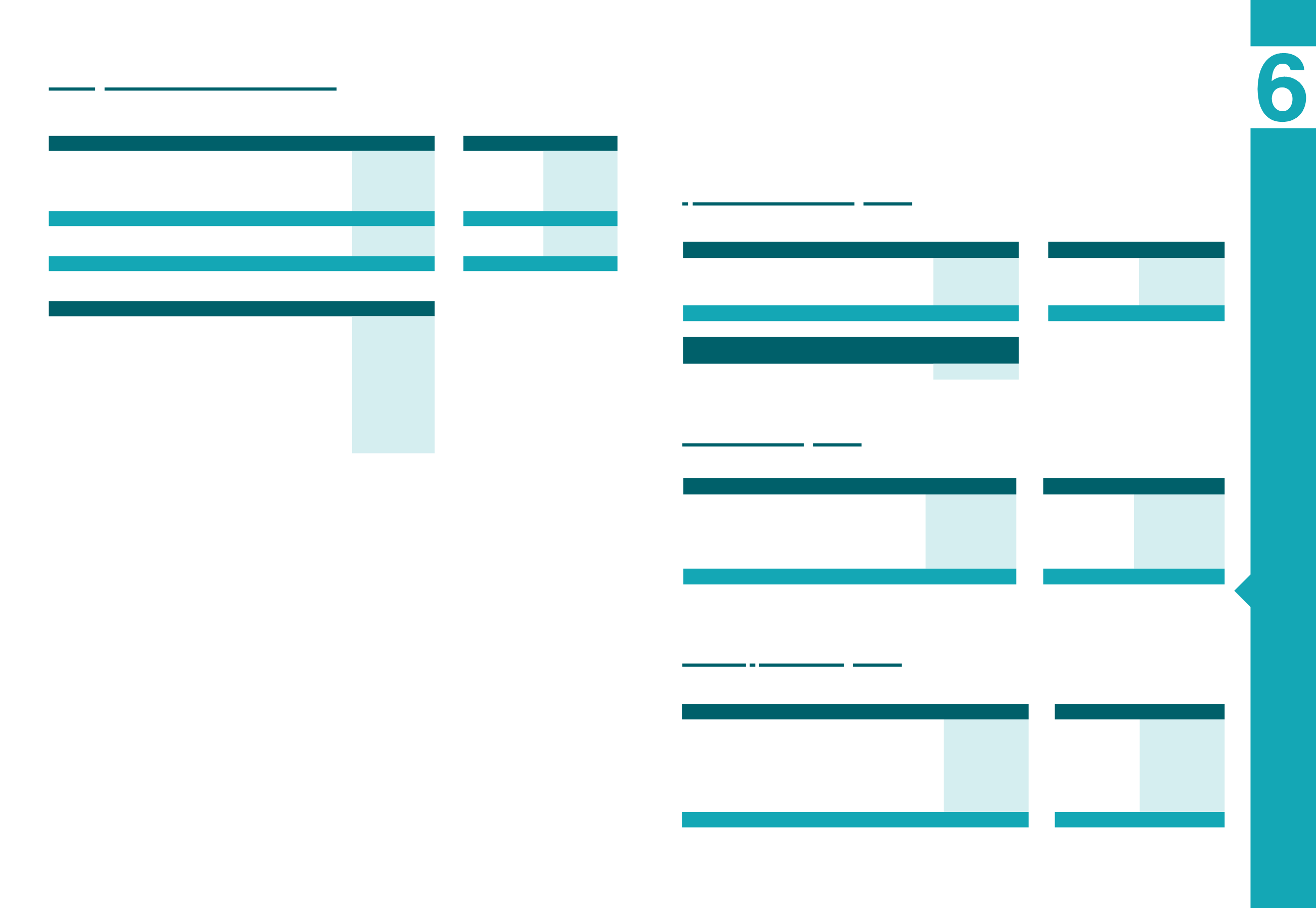

4.9 Customers and other trade receivables

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands €)

31/12/2014

31/12/2013

31/12/2014

31/12/2013

Customers

374,000

527,081

11,056

350

Notes receivable

-

4

-

-

Checks receivable

4,283

5,127

1,917

35

Less: Impairment Provisions

(5,498)

(15,548)

(3,479)

-

Net trade Receivables

372,786

516,664

9,494

385

Advances for inventory purchases

139

147

-

-

Advances to trade creditors

34,093

47,553

-

-

Total

407,018

564,363

9,494

385

MYTILINEOS GROUP

Construction Contracts

31/12/2014

31/12/2013

Realised Contractual Revenues

597,806

595,744

Realised Contractual Cost & Profits (minus realised

losses)

3,481,076

3,253,185

Advances received

(47,303)

(27,291)

Clients holdings for good performance

120,018

175,440

Receivables for construction contracts according to the

percentage of completion

63,130

27,179

Liabilities related to construction contracts according to

percent. of completion

(182,691)

(134,150)

On 11/4/2014, LAGIE sent a credit note amounting to

€

8.5m in total

to the Subsidiary Company, in application of subparagraph IC.3 of

Law 4254/2014. Specifically, this regulation provides that producers

of High-Efficiency CHP are obliged to issue a credit invoice by which

they provide a 10% discount on the total value of the energy that they

dispatched to the system during 2013. Additionally, said regulation

characteristically states that until the relevant credit invoice is issued

and delivered to LAGIE, the latter’s obligation to pay the tariff for the

amount of energy which dispatched but not paid for is suspended.

The special levy imposed by Law 4093/2012 was intended to con-

solidate the Special Account by way of an intervention/’haircut’ for

high guaranteed prices which applied to RES and (small) High-Ef-

ficiency CHP stations during previous years and during the period

of 2012-2014. However, during said time period, CHP neither issued

invoices nor was paid a tariff in accordance with the provisions of

Law 4001/2011. Instead, following the conclusion of the Private Agree-

ment between the Subsidiary and LAGIE on 26.4.2013, CHP issued

temporary invoices, for the aforementioned period in its entirety, at the

minimum tariff which could have resulted from the application of the

mathematical formula established by Law 4001/2011 (if the CC value

was set at the unit price, i.e. if the Mean Average Natural Gas Price

amounted to 26

€

/MWh). It must also be noted that except for Alumin-

ium of Greece’s High-Efficiency CHP, almost all other H-E-CHP plants

(agricultural & district heating) operating in Greece have already been

retrospectively exempted from the special 10% levy by way of the pro-

visions of Laws 4203/2013 and 4123/2013.

Furthermore, it is clear from both the letter and the rationale of the pro-

vision that if the total value of the electricity dispatched by the Subsidi-

ary’s HE-CHP is unknown or has not been

determined because of the absence of a

fixed tariff (failure of the Minister of Environ-

ment, Energy and Climate Change to issue

the anticipated Ministerial Decision), the

credit invoice cannot be issued in principle.

It is noted that the -de facto- compensation

received by Aluminium of Greece for the

electricity dispatched to the system during

the period of 28.11.2012-31.3.2014, which

corresponded to the minimum price which

could have resulted from the application of

the mathematical formula established by

Law 4001/2011 (if the CC value was set at

the unit price, or, otherwise, if the Mean Av-

erage Natural Gas Price amounted to 26

€

/

MWh), cannot in any case be deemed to

amount to a “tariff” which would allow for

the determination of the ‘total value’ of the

High-Efficiency CHP energy dispatched

to the system. Therefore, the claim that a

credit invoice may be issued using a tem-

porary price is illegal, since it is contrary to

both the letter and spirit of the law.

Accordingly, the Subsidiary has issued the

relevant credit invoice to LAGIE, recording

all of the aforementioned reservations, so

that LAGIE’s obligation to pay for the elec-

tricity that was both dispatched to the system and invoiced is not suspended, which would unjustifiably burden

the Company’s liquidity, in violation of both the letter and the logic of the law. At the same time, the Subsidiary has

recorded said amount amongst its assets, given that, for the reasons mentioned above, it considers it certain that

the respective amount will be recovered in its totality.

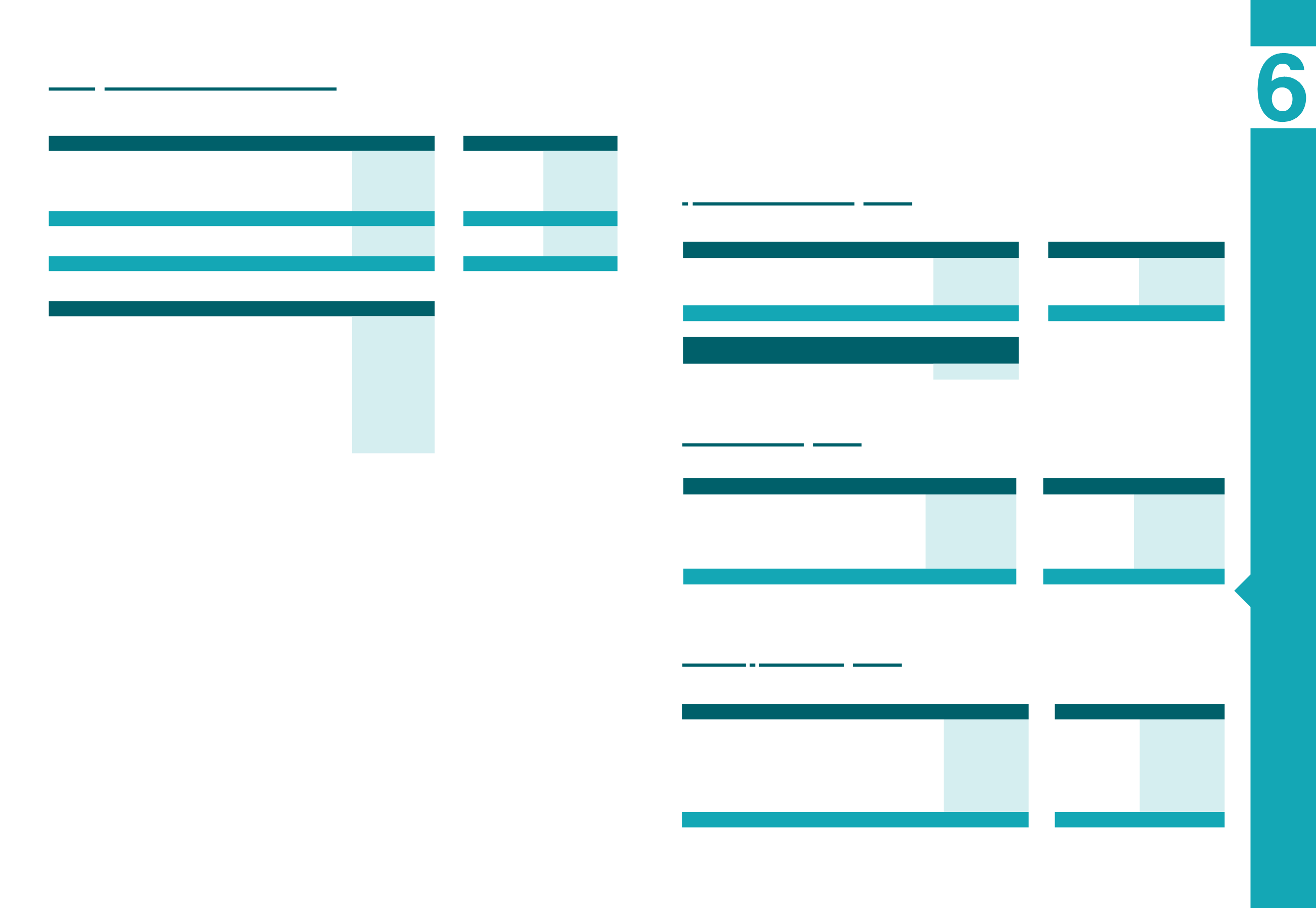

4.10 Cash and cash equivalents

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014

31/12/2013

31/12/2014

31/12/2013

Cash

283

292

15

13

Bank deposits

92,290

63,051

771

3,430

Time deposits & Repos

220,855

118,427

-

-

Total

313,428

181,770

786

3,443

The weighted average interest

rate is as:

31/12/2014

31/12/2013

Deposits in Euro

1.61%

1.52%

4.11 Suppliers and other liabilities

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014

31/12/2013

31/12/2014

31/12/2013

Suppliers

268,316

350,118

13,645

2,137

Cheques Payable

3

-

-

-

Customers’ Advances

34,678

37,273

1,710

4,144

Liabilities to customers for project

implementation

182,136

81,559

-

-

Total

485,133

468,950

15,355

6,281

4.12 Other short-term liabilities

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014

31/12/2013

31/12/2014

31/12/2013

Liabilities to Related Parties

1,336

1,137

123,984

119,854

Accrued expense

20,235

14,910

23

6

Social security insurance

3,346

3,747

177

165

Dividends payable

401

692

49

258

Deferred income-Grants

1,051

-

-

-

Others Liabilities

11,352

11,882

1,080

(173)

Total

37,720

32,368

125,314

120,109