135

134

Annual Financial Statements

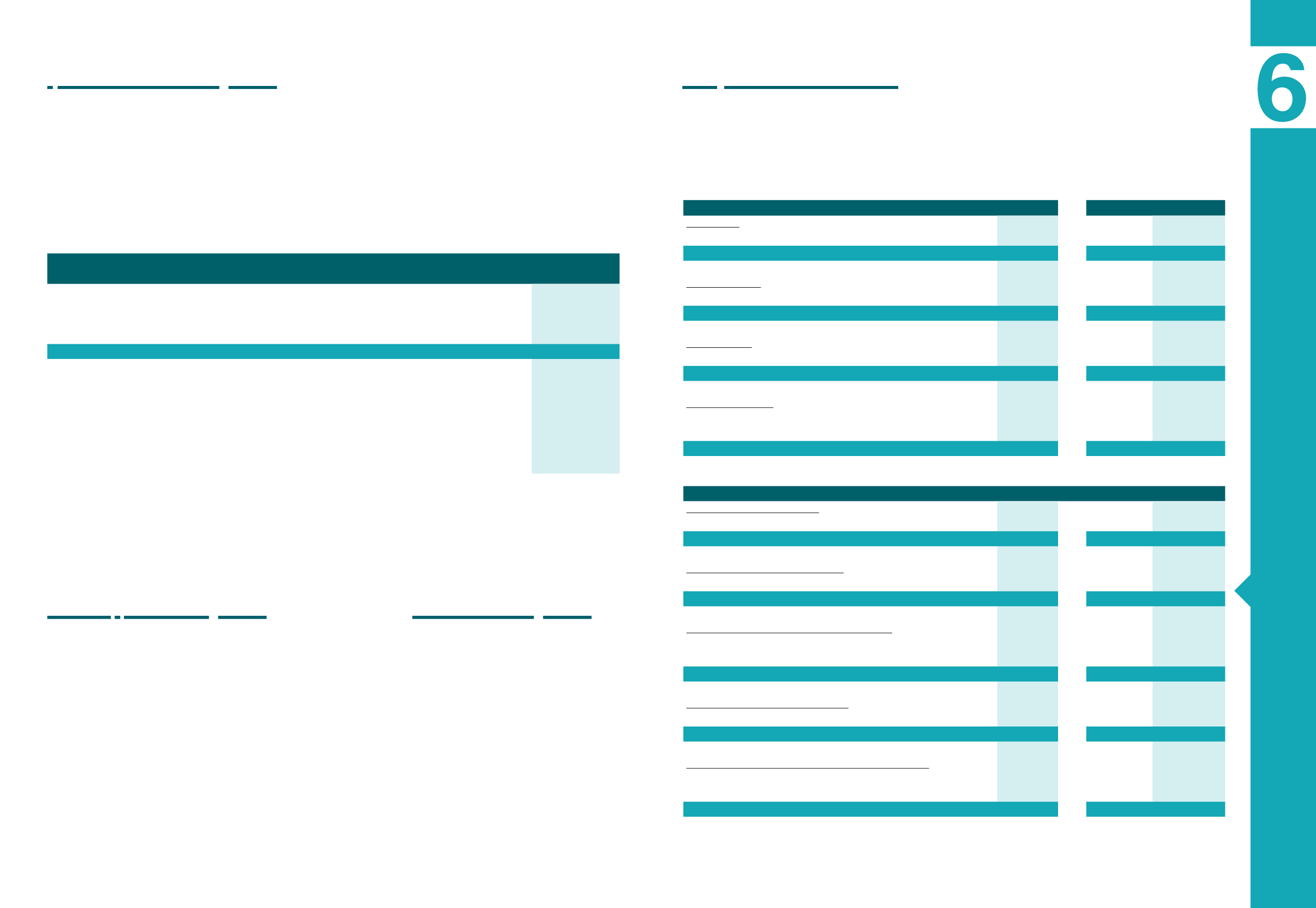

4.32 Capital Management

The primary objective of the Group’s capital management is to ensure the continuous smooth operation of its business

activities and the achievement of its growth plans combined with an acceptable credit rating. For the purpose of capital

management, the Group monitors the ratios “Net Debt to EBITDA” and “Net Debt to Equity”. As net debt, the Group

defines interest bearing borrowings minus cash and cash equivalents. The ratios are managed in such a way in order

to ensure the Group a credit rating compatible with its strategic growth.

The table below presents ratio results for the years December 31, 2014 and 2013 respectively:

MYTILINEOS GROUP

2014

2013

(Amounts in thousands

€

)

Long-term debt

524,023

435,115

Short-term debt

120,748

91,643

Current portion of non-current liabilities

42,090

164,668

Cash and cash equivalents

(313,428)

(181,770)

Group Net debt

373,434

509,656

Oper.Earnings before income tax, financial results, depreciation and amortization

253,943

225,305

EQUITY

1,161,226

1,090,347

Group Net debt / Oper.Earnings before income tax, financial results, depreciation and

amortization

1.47

2.20

Group Net debt / EQUITY

0.32

0.46

The Company does not manage its capital on Company level but only

on a Group level.

The Group, because of bank loans, has the obligations as the ratio of

net debt to equity is less than one.

4.33 Dividend Proposed and Payable

The BOD will not propose to the General Assembly of the Sharehold-

ers (GA) the distribution of dividend. However, the BOD will propose

with a special report, to the GA a Share capital return for a total amount

that corresponds to 0,10

€

/ share.

4.34 Number of employees

The number of employees at 31/12/2014

amounts to 1.807 for the Group and to 73

for the Entity. Accordingly, at 31/12/2013,

the number of employees amounted to

1.756 and 60.

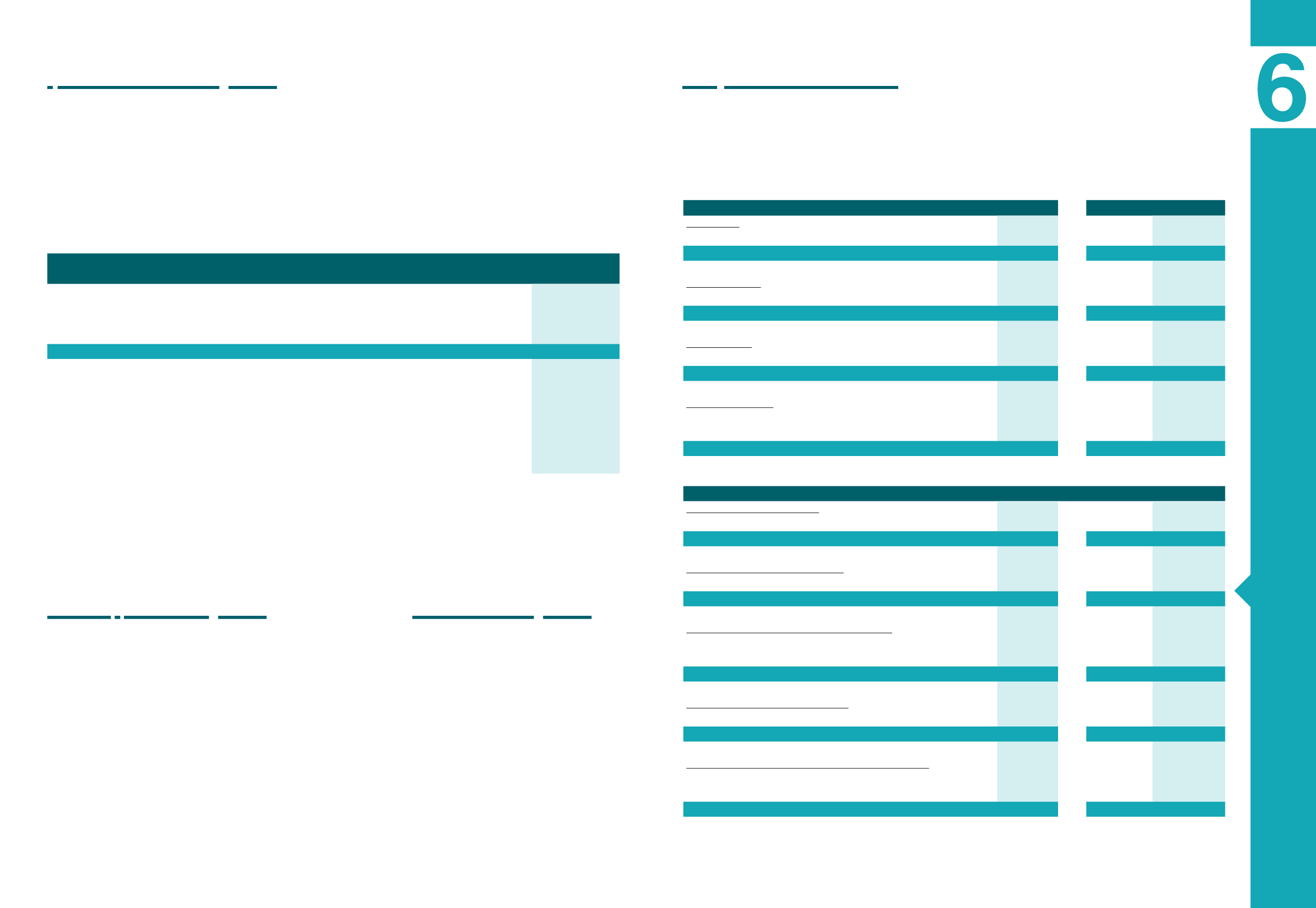

4.35 Related Party transactions

The above mentioned related party transactions are on a pure commercial basis. The Group or any of its related

parties has not entered in any transactions that were not in an arm’s length basis, and do not intent to participate

in such transactions in the future. No transaction from the above mentioned had any special terms and there were

no guarantees given or received.

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014 31/12/2013

31/12/2014 31/12/2013

Stock Sales

Subsidiaries

-

-

14,410

16,919

Total

-

-

14,410

16,919

Stock Purchases

Subsidiaries

-

-

14,386

16,889

Total

-

-

14,410

16,919

Services Sales

Subsidiaries

-

-

23,406

12,380

Total

-

-

23,406

12,380

Services Purchases

Subsidiaries

-

-

8,504

6,653

Management remuneration and fringes

15,286

13,756

2,952

2,963

Total

15,286

13,756

11,456

9,616

MYTILINEOS GROUP

MYTILINEOS S.A.

31/12/2014 31/12/2013

31/12/2014 31/12/2013

Loans given to Related Parties

Subsidiaries

-

-

-

-

Total

-

-

-

-

Loans received from Related Parties

Subsidiaries

-

-

158,541

157,277

Total

-

-

158,541

157,277

Balance from sales of stock/services receivable

Subsidiaries

-

-

14,152

552

Management remuneration and fringes

-

-

-

-

Total

-

-

14,152

552

Guarantees granted to related parties

Subsidiaries

-

-

1,107,881

1,327,473

Total

-

-

1,107,881

1,327,473

Balance from sales/purchases of stock/services payable

Subsidiaries

-

-

8,791

6,100

Management remuneration and fringes

-

-

64

49

Total

-

-

8,855

6,149