129

128

Annual Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014 31/12/2013

31/12/2014 31/12/2013

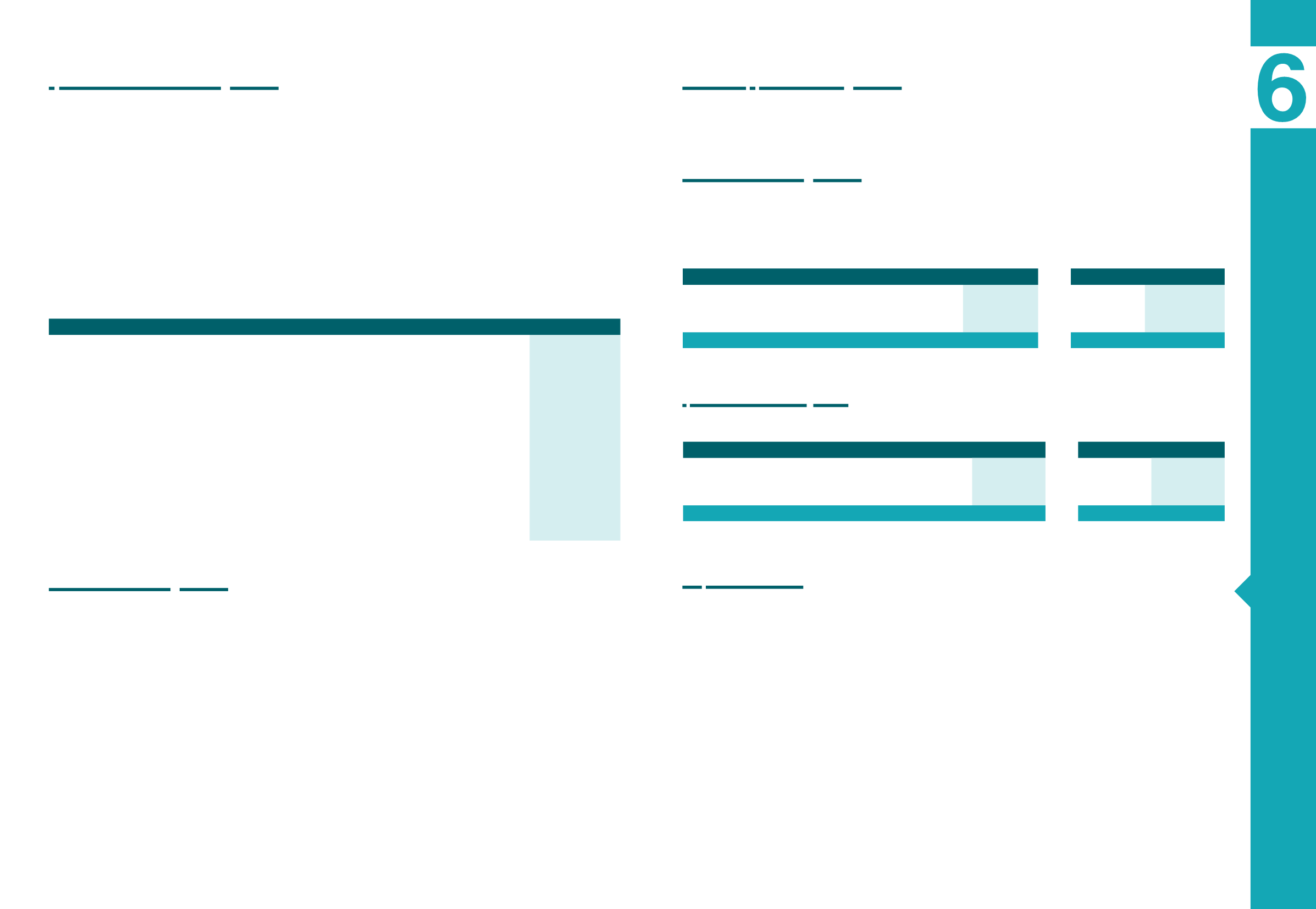

Commitments from construction contracts

Value of pending construction contracts

1,292,605

2,242,374

-

-

Granted guarantees of good performance

340,310

372,437

-

-

Total

1,632,915

2,614,811

-

-

4.25 Discontinued Operations

The Group, since 2009, applies IFRS 5 “Non-current assets held for

sale & discontinued operations”, and presents separately the assets

and liabilities of the subsidiary company SOMETRA S.A., following

the suspension of the production activity of the Zinc-Lead production

plant in Romania, and presents also the amounts recognized in the

income statement separately from continuing operations. Given the

global economic recession, there were no feasible scenarios for the

alternative utilization of the aforementioned financial assets. For that

reason the Group plans to abandon the Zinc-Lead production while

exploiting the remaining stock of the plan. Consequently, by applying

par. 13 of IFRS 5 “Non-current assets Held

for Sale” the Zinc-Lead production ceases

to be an asset held for sale and is consid-

ered as an asset to be abandoned. The

assets of the disposal group to be aban-

doned are presented within the continuing

operations while the results as discontin-

ued operations.

Following is presented the analysis of

the profit and loss of the discontinued

operations.

MYTILINEOS GROUP

(Amounts in thousands

€

)

1/1-31/12/2014 1/1-31/12/2013

Sales

7,713

6,339

Cost of sales

(5,406)

(4,155)

Gross profit

2,307

2,184

Other operating income

711

655

Distribution expenses

(650)

(445)

Administrative expenses

(1,958)

(1,867)

Other operating expenses

(630)

(706)

Earnings before interest and income tax

(220)

(179)

Financial income

-

1

Financial expenses

(39)

(24)

Profit before income tax

(259)

(202)

Profit for the period

(259)

(202)

4.26 Sale of Treasury Shares

On 7.12.2007, the Board of Directors of the Company resolved on

the commencement of the plan regarding the acquisition of treasury

shares, in implementation of the decision of the Extraordinary General

Meeting of the Company’s shareholders of 07.12.2007. In the period

from 13.12.2007 until 06.12.2009, the Company would acquire up to

6.053.907 treasury shares, at a minimum acquisition price of 2,08

€

/

share and a maximum acquisition price of 25

€

/share (amounts ad-

justed for the shares split of 19.12.2007). Following, the Company can-

celled 5,635,898 own shares by the 2nd Repeat General Meeting of

the Company’s Shareholders of June 3rd.

MYTILINEOS HOLDINGS S.A. on 18 October 2013, pursuant to its

BoD resolution on 17 October 2013, sold 4,972,383 treasury shares

at the price of

€

5.13 per share for a total

consideration of

€

25,508,325. Following

the above mentioned transaction MYTILI-

NEOS HOLDINGS S.A. does not hold any

treasury stock.

Total number of treasury shares were ac-

quired by Fairfax Financial Holdings Lim-

ited, a financial services holding company.

As of 18 October 2013, the interest held by

Fairfax in MYTILINEOS Group stands at

5,02% making Fairfax the third largest MY-

TILINEOS Group shareholder.

4.27 Encumbrances

Group’s assets are pledged for an amount of 323,7 m as bank debt collateral.

4.28 Commitments

Group’s commitments due to construction contracts and finance lease are as follows:

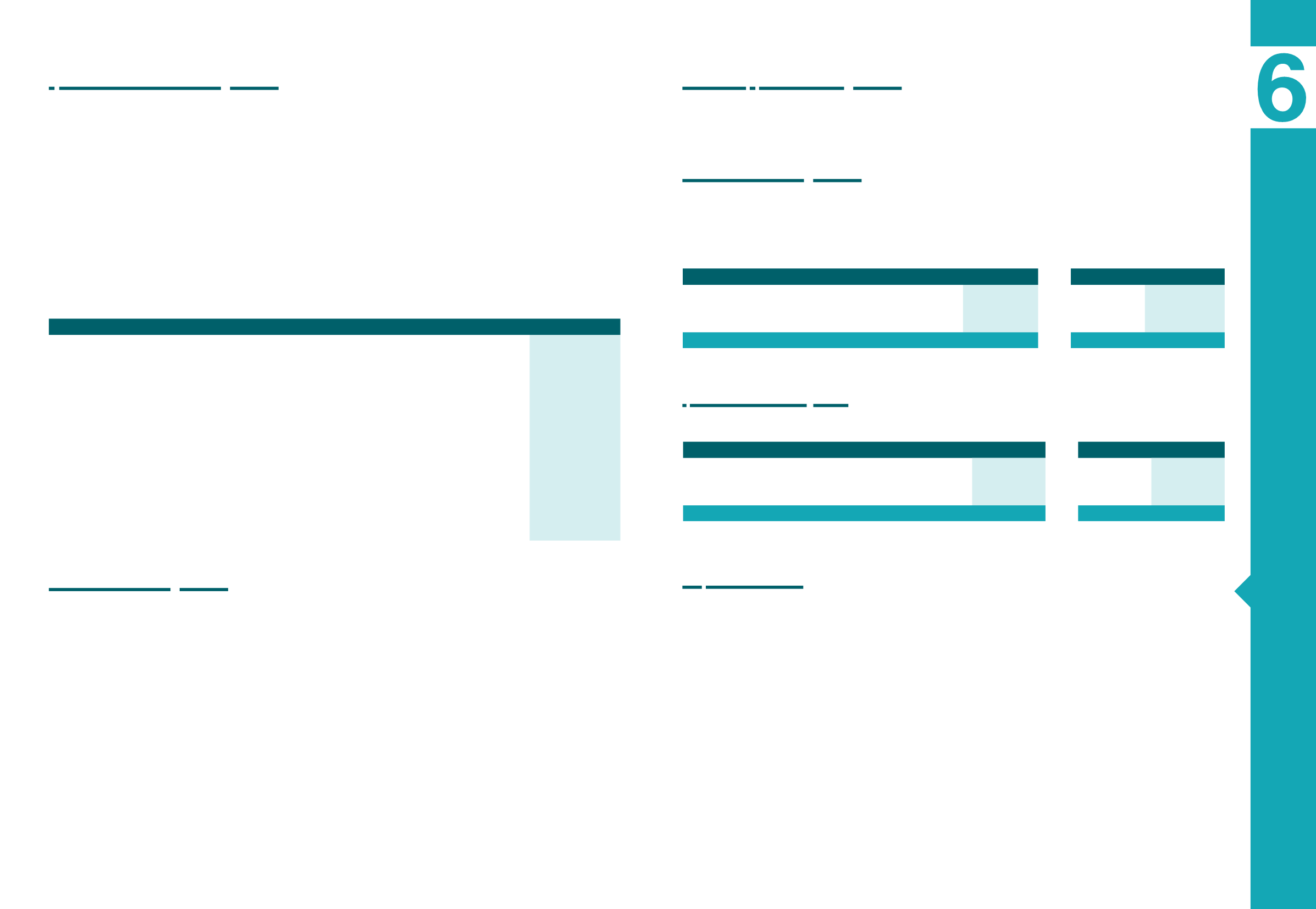

4.29 Operating Leases

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2014 31/12/2013

31/12/2014 31/12/2013

Until 1 year

3,028

2,584

265

124

1 to 5 years

10,945

8,432

1,006

207

> 5 years

14,433

-

349

-

Total Operating Lease

28,407

11,016

1,621

331

4.30 Financial Risk Factors

The Group’s activities expose it to a variety of financial risks:

market risk (including foreign exchange risk and price risk),

credit risk, liquidity risk, cash flow risk and fair value interest-

rate risk. The Group’s overall risk management program focus-

es on the unpredictability of commodity and financial markets

and seeks to minimize potential adverse effects on the Group’s

financial performance. The Group uses derivative financial in-

struments to hedge the exposure to certain financial risks.

Risk management is carried out by a central treasury depart-

ment (Group Treasury) under policies approved by the Board

of Directors. Group Treasury operates as a

cost and service centre and provides ser-

vices to all business units within the Group,

co-ordinates access to both domestic and

international financial markets and manag-

es the financial risks relating to the Group’s

operations. This includes identifying, eval-

uating and if necessary, hedging financial

risks in close co-operation with the various

business units within the Group.