50

51

MYTILINEOS HOLDINGS - SUSTAINABILITY REPORT

2016

8.5.3 Responsible communication and marketing

The correctness of the forms of communication and marketing

that MYTILINEOS Group is applying is assured by monitoring

and integrating all developments in the relevant laws and by

applying responsible practices that govern “below-the-line”

promotion of the Group’s products and subsidiaries, the “above-

the-line” communication at the central corporate level, as well as

the communication of our sponsorships and social contribution

programmes. The Group seeks to provide transparent information

and to ensure that its messages are fully understood by all its

clients as well as by all its other Stakeholder groups

To this end, the communication associates, of both the Corporate

Centre and the Group’s subsidiaries, are bound by the Hellenic

Code of Advertising-Communication Practice, compliance with

which is established on an advisory, preventive or even corrective

basis by the Communication Control Board, in line with Greek

laws. According to the Code’s principles, all advertising should be

legal, decent, honest and truthful, should be prepared with a due

sense of social responsibility and should conform to the principles

of fair competition as this is generally accepted in the market.

During 2016 there were no incidents of non-compliance with the

regulations and voluntary codes on marketing communications,

including product promotion and sponsorships, involving the

implementation of the Group’s communication strategy. the

Group’s products are not subject to any restrictions as regards

their sale to specific markets and no significant issues of concern

were raised by the Group’s Stakeholders in connection with

products and their marketing communication.

G4-PR6 G4-PR7

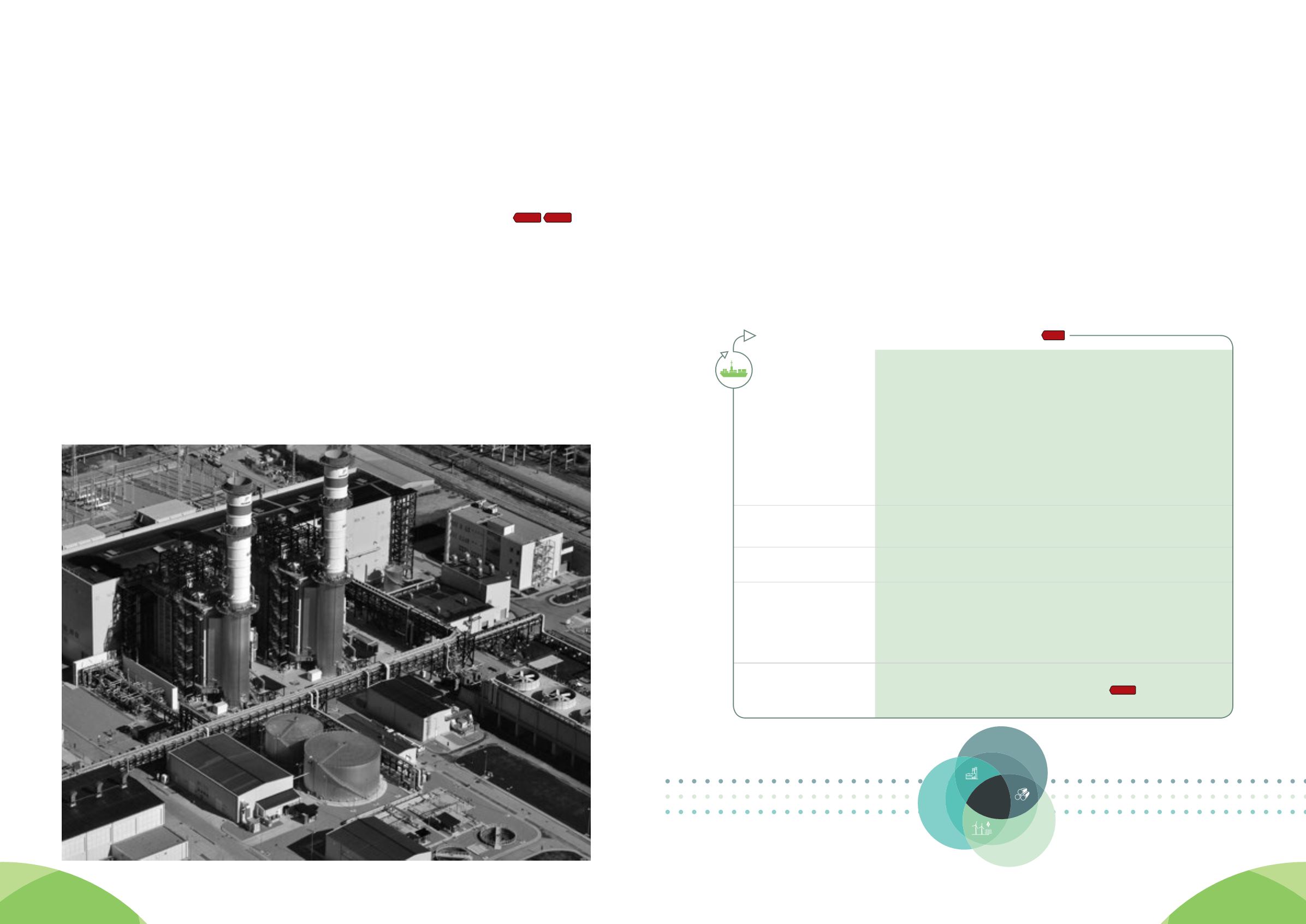

8.5.4 Supply Chain

Developing and maintaining an efficient, high-quality supply chain

is a commitment in which the Group has invested and continues

to invest through permanent associations on the national and local

level. In this direction, the role of the Group key business partners

and suppliers is very essential, as they are an integral part of this

effort.

The Group’s supply chain, taking into account all three of the Group’s

business activity sectors, numbers more than 5,000 suppliers, of

which 86% are based in Greece.

2016 Highlights

• Completion of the 1st edition of the “Code of Conduct for

Suppliers and Business Partners” in the Metallurgy & Mining

Sector and the Energy sector. With the issuance of this Code,

the supply chain of all of the Group’s activity sectors has now

been covered.

• The Group spent

over €280 million, up by 7%

compared to

2015, in outlays to its domestic suppliers, thus benefiting

significantly the local communities and contributing, in an

indirect way, in the efforts to maintain jobs and create income.

• Communication, on the initiative of ALUMINIUM of GREECE,

with

177 key suppliers

(December 2016), to inform them of

the new Code Conduct for Suppliers and Business Partners

in the Metallurgy & Mining Sector and urging them to align

their practices with it. The suppliers’ positive responses to this

invitation were substantial, reaching a rate of

66%

. The main

results of this initiative with regard to the suppliers’ product

quality, environmental management and the Health & Safety

of their employees were the following: 77% of them hold an

ISO9001 quality certificate; 39% hold an ISO 14001 environmental

management certificate; and 32% hold an OHSAS 180011 Health &

Safety certificate. When the further processing of results has been

completed in 2017, specific actions to strengthen partnerships

and cooperation will be designed, if necessary.

Total number of suppliers

• Total number of suppliers

: 5,002

Geographical

distribution of suppliers

• Greece: 86%

• Abroad : 14%

Main supplier categories

• Producers of Raw Materials

• Subcontractors

• Manufacturers

• Distributors

• Spare parts producers

• Wholesalers

• Suppliers of Studies & Investments

Outlays to suppliers

• Total expenditures:

€621.2m

• Percentage of total expenditures to Greek suppliers:

46%

• Percentage of total expenditures to suppliers abroad: 54%

G4-12

G4-EC9

Business activities

requiring services or

products from the

supply chain

• Production & Maintenance of the alumina chemical industry and the primary-cast

aluminium metallurgy

• Plant Production Department, regarding the purchase of raw or other materials

• Construction Department, regarding the purchase of equipment for carrying out EPC

projects

• Logistics Department, regarding the delivery methods and times for products in various

countries.

• Operation and Maintenance of Energy Complexes (thermal power plants)

• Development, construction and maintenance of RES-based plants (Wind Farms,

Photovoltaic Parks, Hydropower Plants

• Retail activity

• Studies - Investments

• Logistics, Administrative, Financial, Legal and other Services

Basic description of MYTILINEOS Group Supply Chain