33

S U S TA I NAB I L I T Y R E PORT 2 0 1 2

* During the fiscal year 2012, ALUMINIUM S.A. and DELPHI-DISTOMON S.A. received €279,863 and €147,578 of subsidies,

respectively, consisting in refunds of the Special Consumption Tax on fuel and of employer contributions paid to the Em-

ployment and Vocational Training Account [LAEK] of the Manpower Employment Organisation [OAED].

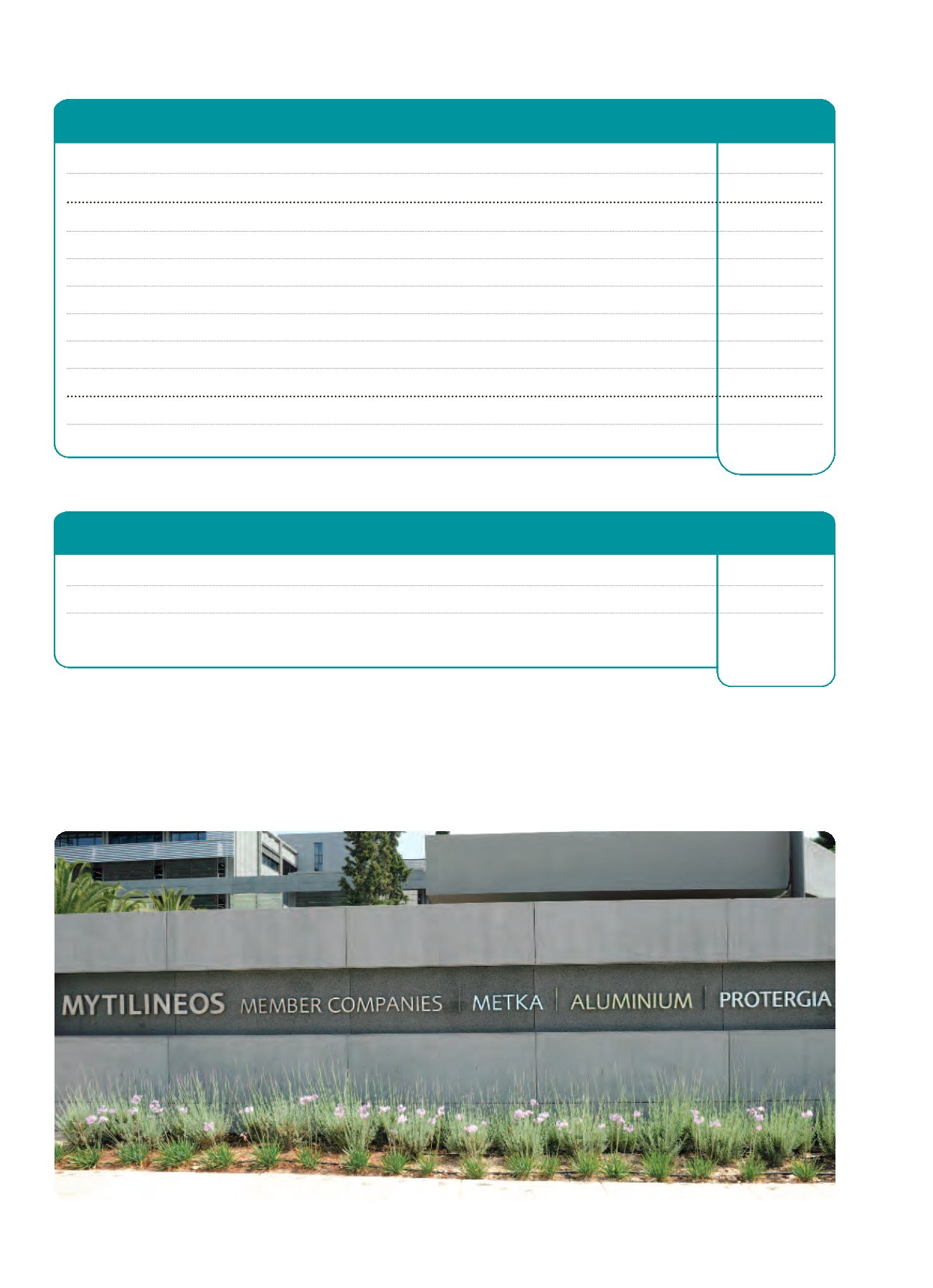

Economic Value Table

2010

2011

2012

Economic value created

Turnover (€)

1,001,351,000

1,570,998,231

1,453,635,665

Economic value distributed

Operating costs (€)

850,470,000

1,394,182,732

1,355,008,786

Employee salaries and benefits (€)

87,290,000

92,019,145

82,131,707

Payment of income tax & other taxes (€)

38,566,000

67,666,347

32,942,394

Payments to capital providers (€)

6,154,000

30,208,942

54,263,639

Investments in local communities (€)

1,062,667

1,221,835

741,607

Total (€)

983,542,667

1,585,299,001

1,623,715,012

% of economic value which is distributed

98.2%

100.9%

111.7%

% of economic value which is retained

1.8%

-0.9%

-11.7%

Significant financial assistance*

received from Government

2010

2011

2012

Tax exemptions / credits (€)

133,398

115,200

0

Subsidies (€)*

282.201

4.816.149

436,841

Investment, research and technology subsidies

and other relevant types of subsidies (€)

1.084.914

133.739

0