106

107

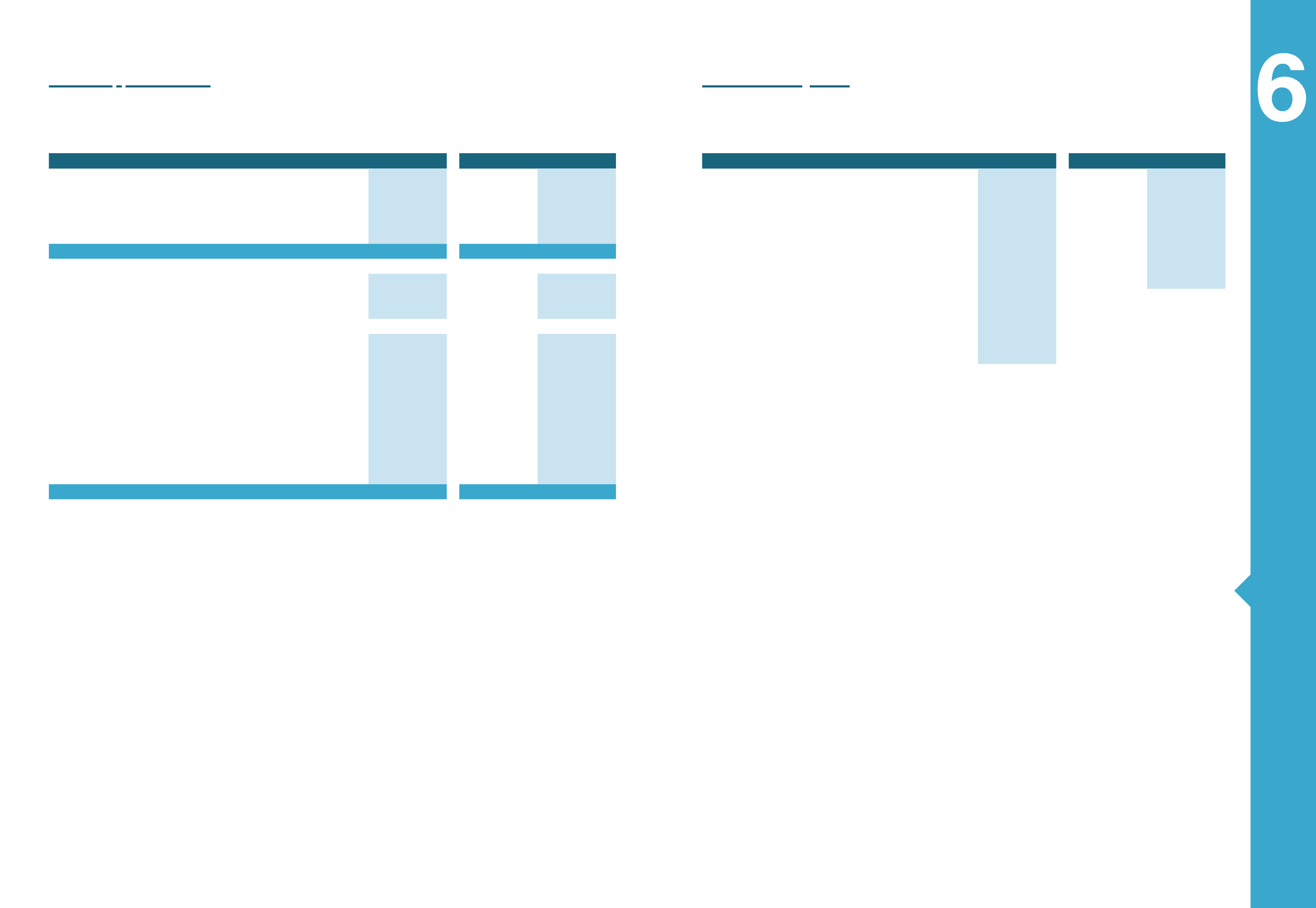

Annual Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Income Tax

22,163

20,269

-

-

Income Tax provision

1,164

(523)

760

-

Deferred taxation

4,008

1,887

(2,194)

(2,504)

Extraordinary Income Tax

102

57

-

-

Other Taxes

941

953

-

-

Total

28,379

22,643

(1,434)

(2,504)

Earnings before tax

108,791

136,311

(1,705)

(4,728)

Nominal Tax rate

0.29

0.26

-

-

Tax calculated at the statutory tax rate of 26%

31,549

35,566

-

-

Nominal Tax Rate Adjustments - Change in Greek Tax Rate

(744)

-

(1,741)

-

Nominal Tax Rate Difference in foreign Subsidiary Companies

(4,428)

(1,236)

-

-

Non taxable income

(11,419)

(36,383)

-

-

Tax on Non taxable reserves

-

(77)

-

-

Non tax deductible expenses

13,350

12,812

-

-

Income tax from land - plot & buildings

941

946

-

-

Other taxes

68

-

-

-

Income tax coming from previous years

2,138

6,956

760

-

Extraordinary Income Tax

104

57

-

-

Other

(3,180)

4,002

(452)

(2,504)

Effective Tax Charge

28,379

22,643

(1,434)

(2,504)

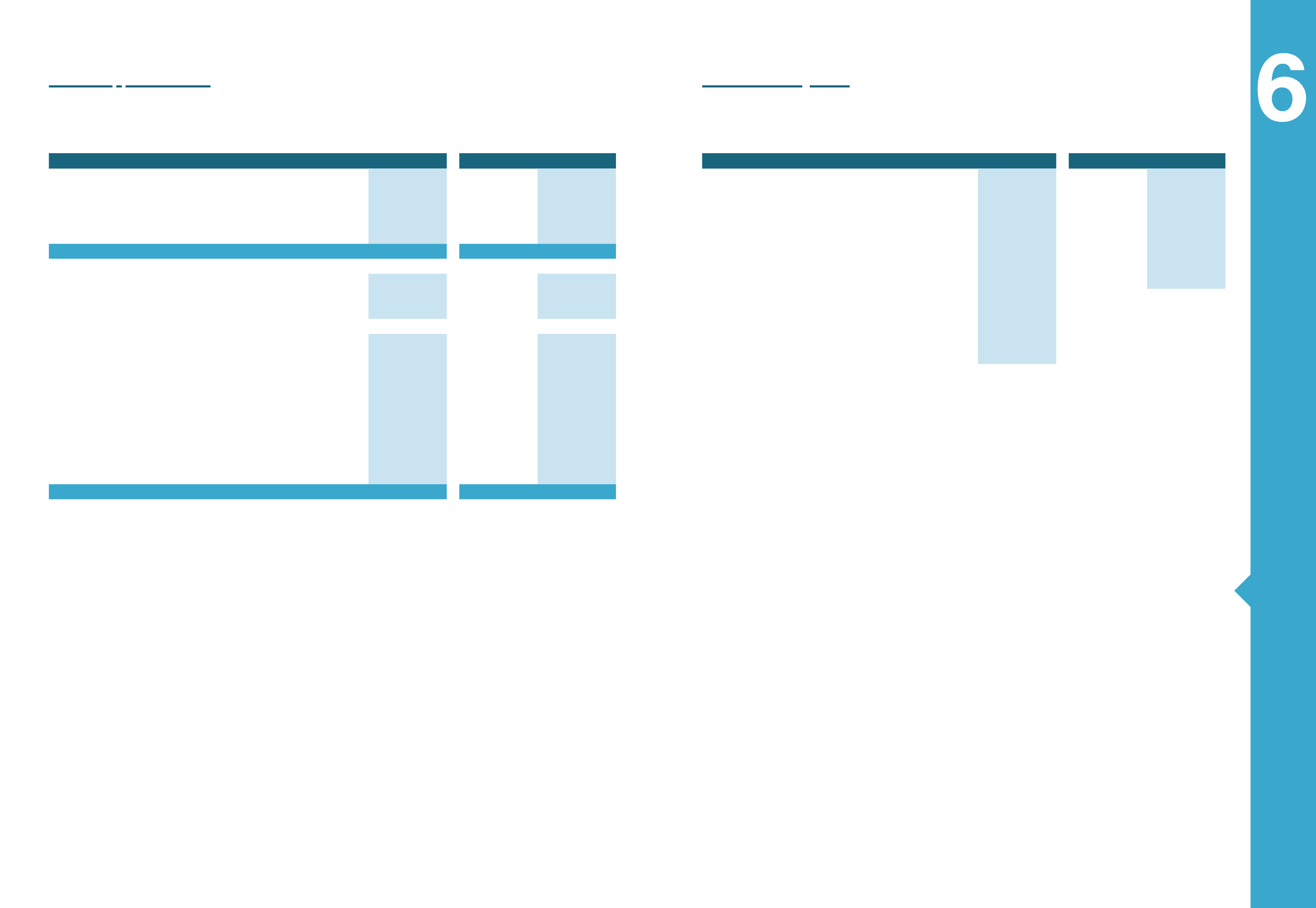

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

1/1-31/12/2015 1/1-31/12/2014

1/1-31/12/2015 1/1-31/12/2014

Equity holders of the parent

47,548

64,890

(271)

(2,224)

Weighted average number of shares

116,916

116,916

116,916

116,916

Basic earnings per share

0,4067

0,5550

(0,0023)

(0,0190)

Continuing Operations (Total)

Equity holders of the parent

52,261

65,149

(271)

(2,224)

Weighted average number of shares

116,916

116,916

116,916

116,916

Basic earnings per share

0,4470

0,5572

(0,0023)

(0,0190)

Discontinuing Operations (Total)

Equity holders of the parent

(4,713)

(259)

Weighted average number of shares

116,916

116,916

Basic earnings per share

(0,0403)

(0,0022)

4.22 Income tax

Income tax for the Group and Company differs from the theoretical amount that

would result using the nominal tax rate prevailing at year end over the accounting

profits. The reconciliation of this difference is analysed above.

Starting with the year 2011 and in accordance with paragraph 5 of Article 82 of

Law 2238/1994, the Group companies whose financial statements are audited by

mandatory statutory auditor or audit firm, under the provisions of Law 2190/1920,

are subject to a tax audit by statutory auditors or audit firms and receives an-

nual Tax Compliance Certificate. In order to consider that the fiscal year was

inspected by the tax authorities, must be applied as specified in paragraph 1a of

Article 6 of POL 1159/2011.

For the fiscal year 2012 and 2013, the Group companies which were subject to

tax audit by statutory auditors or audit firm, received a Tax Compliance Certificate

free of disputes in 2013 and 2014 accordingly.

For the 2014 tax audit, the companies of the Group

which operate in Greece have been subjected to a

tax audit by Sworn Auditors according to article 65A

par. 1 of law 4174/2013 and of law 4262/2014. Said

tax audit has been completed during 2015 and the

tax certificates were distributed by the statutory au-

ditors.

For fiscal year 2015, the tax audit which is being car-

ried out by the auditors is not expected to result in

a significant variation in tax liabilities incorporated in

the financial statements.

The tax audit for the parent company Mytilineos S.A.

for the fiscal years 2007-2010 has been completed

by the relevant authorities of Ministry of Finance. The

differences that arose from said tax audit amounts

to

€

760k.

4.23 Earnings per share

Basic earnings per share are calculated by the weighted average number of ordinary shares.