102

103

Annual Financial Statements

(Amounts in thousands

€

)

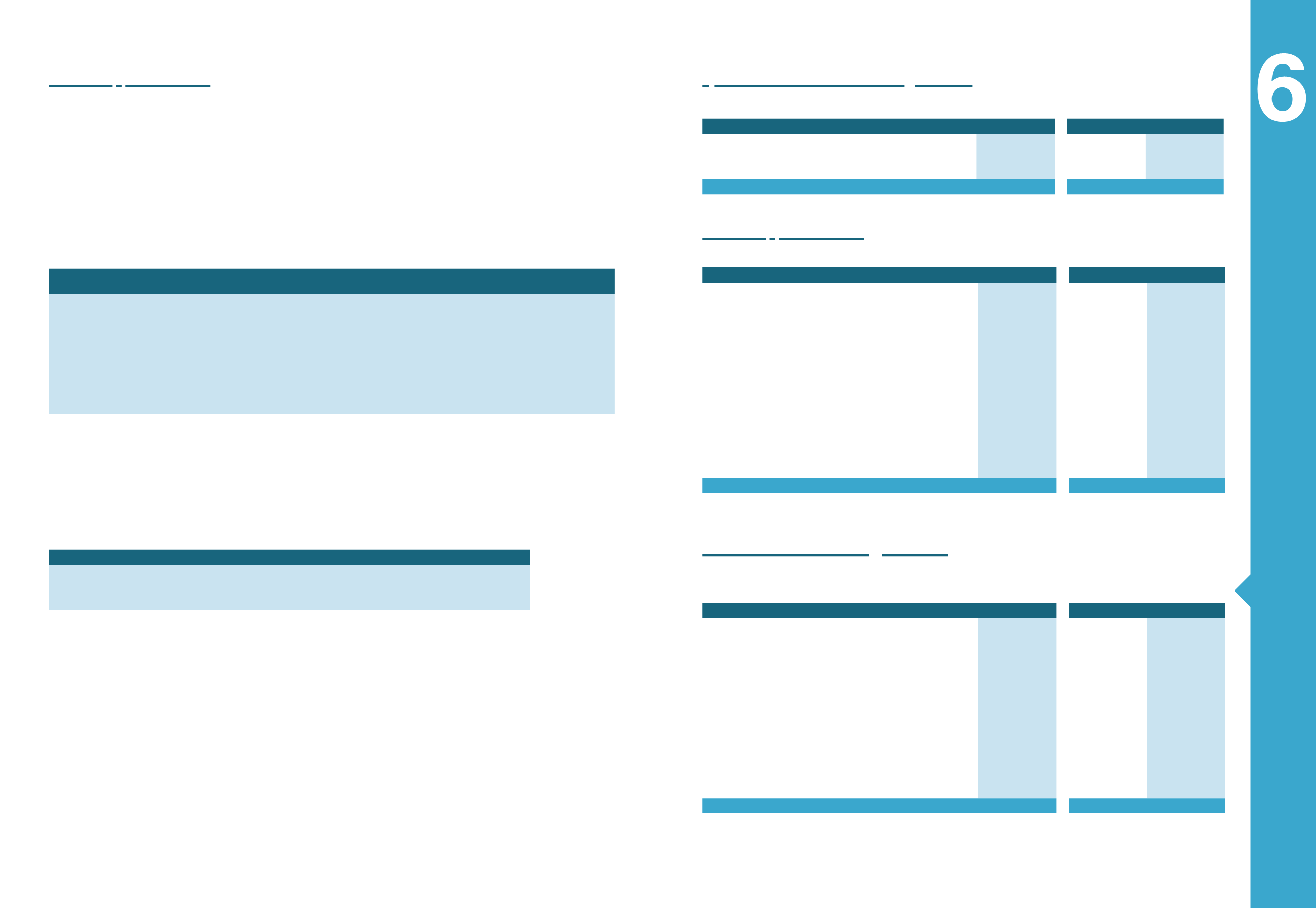

Environmental

Restoration

Tax liabilities

Other

Total

1/1/2014

583

2,549

15,490

18,622

Sale Of Subsidiary

-

(120)

-

(120)

Additional Provisions For The Period

-

6

1,262

1,268

Unrealised Reversed Provisions

-

-

(1,204)

(1,204)

Exchange Rate Differences

-

1

-

1

Realised Provisions For The Period

(174)

-

(2,884)

(3,059)

31/12/2014

408

2,437

12,667

15,512

Long -Term

408

2,437

12,667

15,512

Additional Provisions For The Period

1,039

(9)

1,551

2,582

Exchange Rate Differences

-

1

-

1

Realised Provisions For The Period

(179)

(1,114)

(1,310)

(2,603)

31/12/2015

1,269

1,315

12,909

15,492

Long -Term

1,269

1,315

12,208

14,791

Short - Term

-

-

701

701

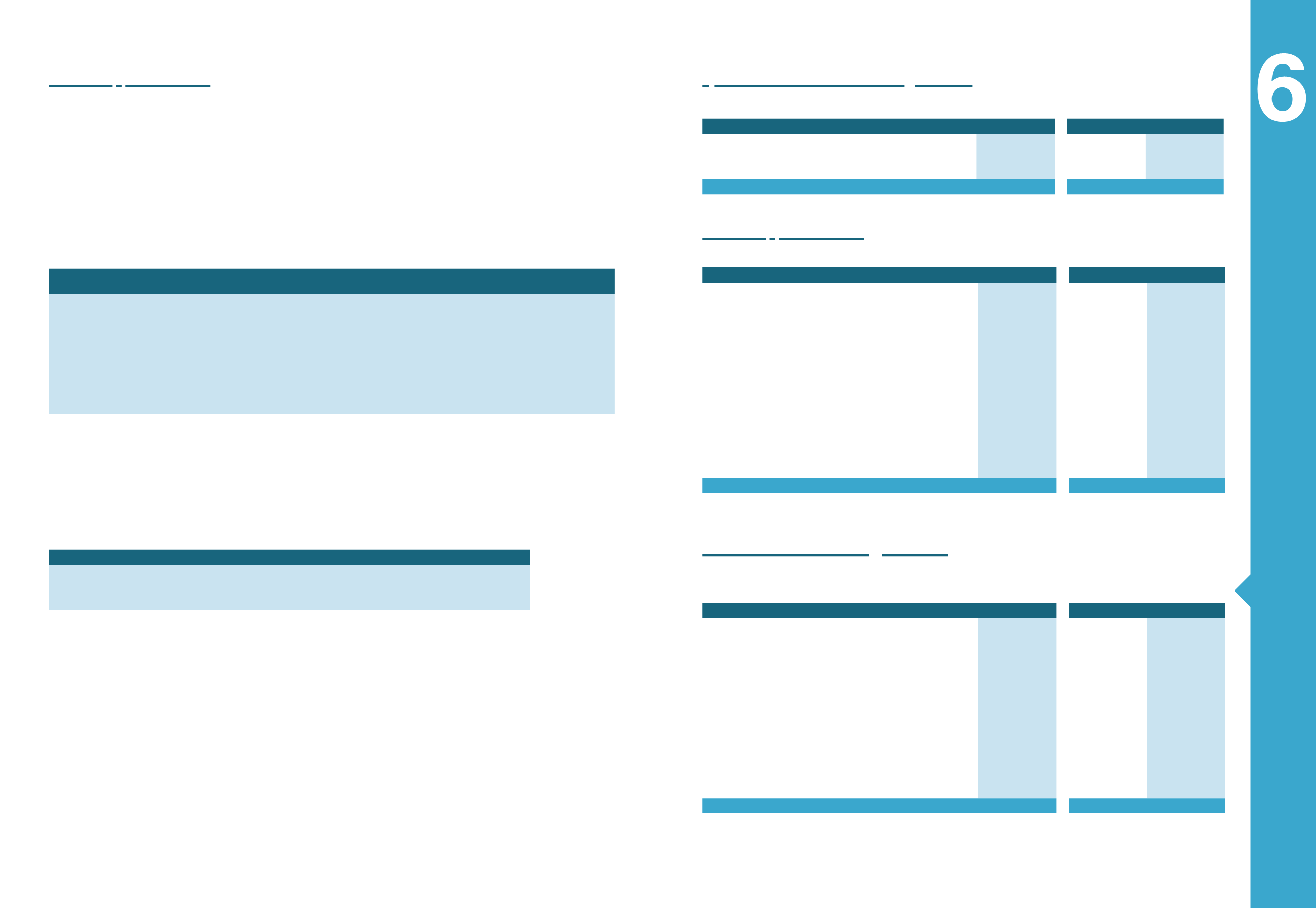

(Amounts in thousands

€

)

Tax liabilities

Other

Total

1/1/2014

1,102

266

1,368

31/12/2014

1,102

266

1,368

Long -Term

1,102

266

1,368

Additional Provisions For The Period

-

683

683

Realised Provisions For The Period

(1,100)

-

(1,100)

31/12/2015

2

949

951

Long -Term

2

266

268

Short - Term

-

683

683

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Tax expense for the period

22,326

11,584

-

-

Tax audit differences

(7)

(7)

-

-

Tax liabilities

14,472

15,177

349

3,107

Total

36,791

26,755

349

3,107

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Retirement benefits

714

115

-

-

Other employee benefits

56,330

63,007

-

-

Cost of materials & inventories

805,659

509,412

13,501

14,386

Third party expenses

96,738

117,795

-

-

Third party benefits

73,141

188,156

-

-

Assets repair and maintenance cost

3,476

3,077

-

-

Operating leases rent

5,013

3,818

-

-

Taxes & Duties

22,252

6,885

-

-

Advertisement

345

375

-

-

Other expenses

34,319

48,085

-

-

Depreciation - Tangible Assets

54,654

47,954

-

-

Depreciation - Intangible Assets

4,764

4,992

-

-

Grants amortization incorporated to cost

(1,051)

(1,886)

-

-

Total

1,156,353

991,785

13,501

14,386

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Distribution expenses

Other emploee benefits

925

871

-

-

Inventory cost

1

1

-

-

Third party expenses

863

636

-

-

Third party benefits

260

87

-

-

Assets repair and maintenance cost

7

7

-

-

Operating leases rent

64

56

-

-

Taxes & Duties

338

184

-

-

Advertisement

117

56

-

-

Other expenses

997

1,090

-

-

Depreciation - Tangible Assets

11

25

-

-

Depreciation - Intangible Assets

12

12

-

-

Total

3,596

3,024

-

-

4.15 Provisions

Provisions referring to Group and Company are recognized if the following are

met: (a) legal or implied liabilities exist as a consequence of past events, (b)

there is a possibility of settlement that will require the outflow if economic benefits

and (c) the amount of the liability can be measured reliably. More specifically,

the Group recognizes provisions for environmental restorations as a result of

exploitation of mineral resources processed mainly for the production of Alumina

and Aluminum. All provisions are reviewed at each balance-sheet date and are

adjusted accordingly so that they reflect the present value of expenses that will

be required for the restoration of the environment. Contingent receivables are not

recognized in the financial statements but are disclosed if there is a possibility of

an inflow of economic benefits.

Environmental Restoration.

This provision rep-

resents the present value of the estimated costs to

reclaim quarry sites and other similar post-closure

obligations.

Tax Liabilities.

This provision relates to future obli-

gations that may result from tax audits.

Other provisions.

Comprise other provisions relat-

ing to other risks none of which are individually ma-

terial to the Group and to contingent liabilities arising

from current commitments.

4.16 Current tax liabilities

4.17 Cost of goods sold

4.18 Administrative & Distribution Expenses