112

113

Annual Financial Statements

MYTILINEOS GROUP

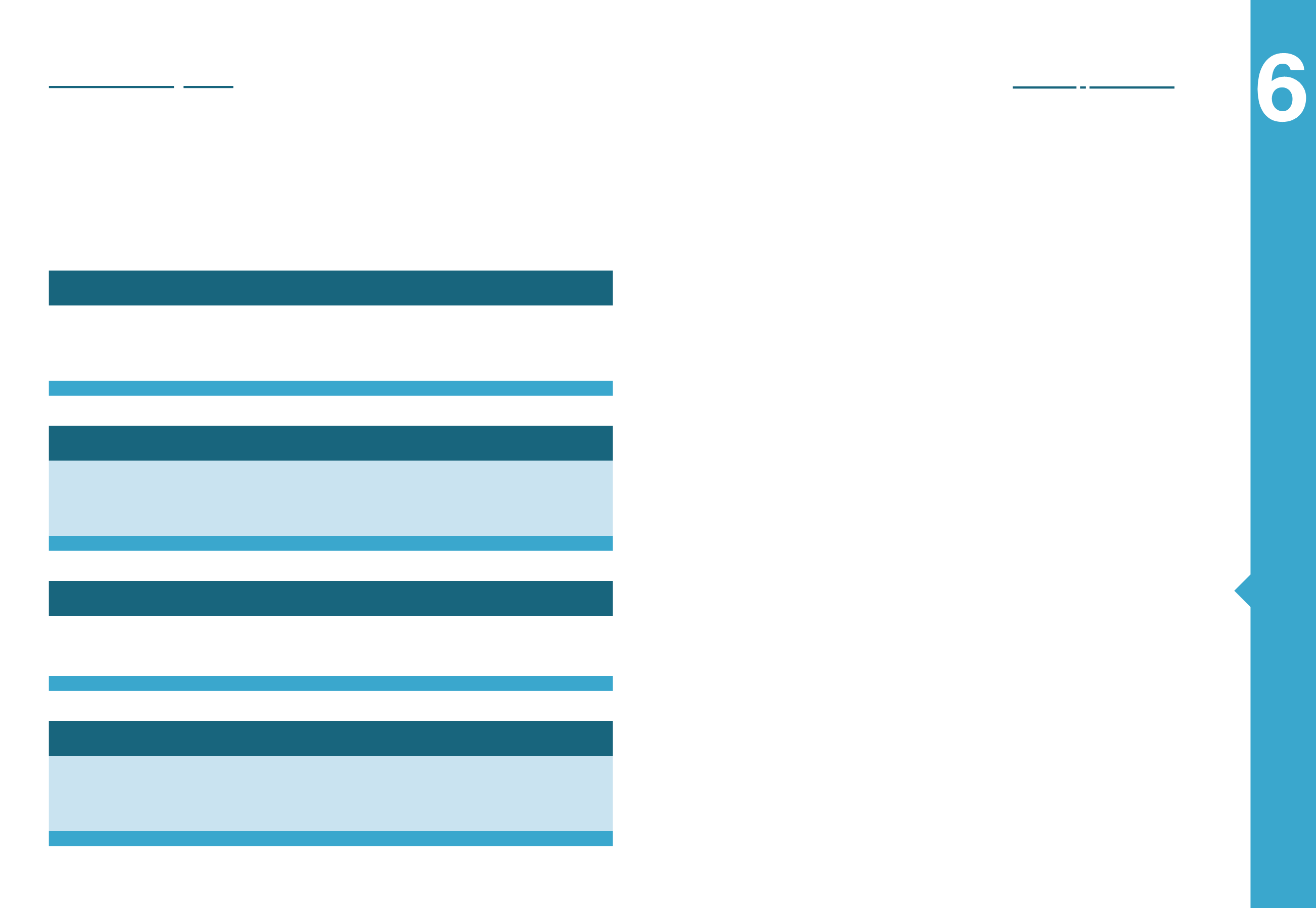

Liquidity Risk Analysis - Liabilities

(Amounts in thousands

€

)

2015

up to 6 months 6 to 12 months 1 to 5 years after 5 years

Total

Long Term Loans

-

20,335

346,452

56,255

423,043

Short Term Loans

41,583

104,105

1,251

526

147,465

Trade and other payables

301,744

16,273

62,609

-

380,627

Other payables

(296,205)

362,073

850

-

66,718

Current portion of non - current liabilities

29,910

134,248

-

-

164,157

Total

77,031

637,034

411,163

56,782

1,182,010

MYTILINEOS GROUP

Liquidity Risk Analysis - Liabilities

(Amounts in thousands

€

)

2014

up to 6 months 6 to 12 months 1 to 5 years after 5 years

Total

Long Term Loans

74

7,432

413,688

102,828

524,023

Short Term Loans

28,084

92,664

-

-

120,748

Trade and other payables

234,917

33,388

24,906

-

293,212

Other payables

(202,703)

251,552

58

-

48,907

Current portion of non - current liabilities

-

42,090

-

-

42,090

Total

60,373

427,126

438,653

102,828

1,028,980

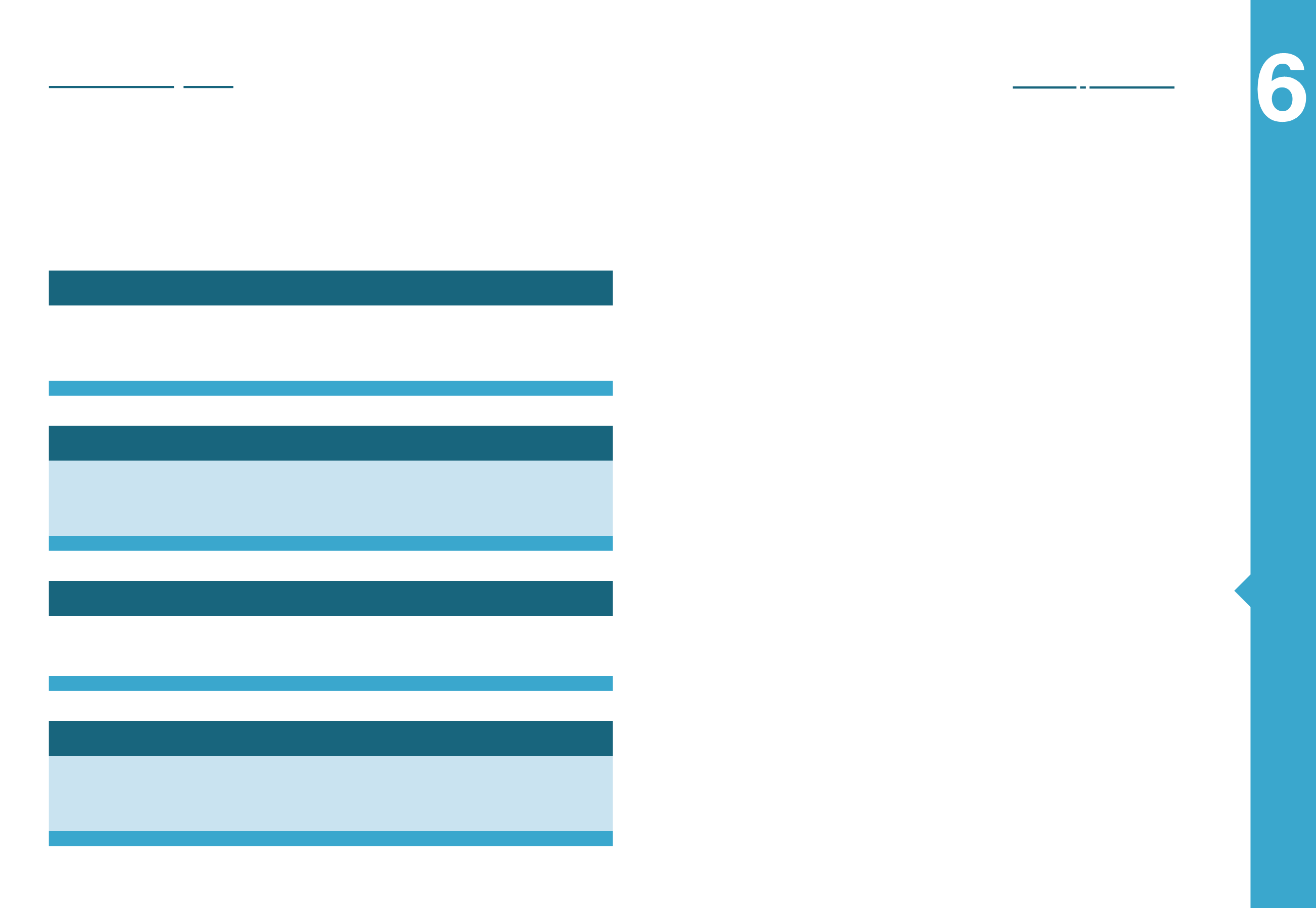

MYTILINEOS S.A.

Liquidity Risk Analysis - Liabilities

(Amounts in thousands

€

)

2015

up to 6 months 6 to 12 months 1 to 5 years after 5 years

Total

Long Term Loans

-

17,245

-

-

17,245

Trade and other payables

4,411

-

13,583

-

17,994

Other payables

2,299

116,913

-

-

119,212

Current portion of non - current liabilities

3,450

3,680

-

-

7,130

Total

10,160

137,838

13,583

-

161,581

MYTILINEOS S.A.

Liquidity Risk Analysis - Liabilities

(Amounts in thousands

€

)

2014

up to 6 months 6 to 12 months 1 to 5 years after 5 years

Total

Long Term Loans

-

7,432

144,549

-

151,981

Short Term Loans

-

3,832

-

-

3,832

Trade and other payables

4,294

-

11,061

-

15,355

Other payables

250

125,064

-

-

125,314

Current portion of non - current liabilities

-

9,167

-

-

9,167

Total

4,544

145,494

155,610

-

305,649

4.29.3 Liquidity Risk

Liquidity risk is related with the Group’s need for the sufficient financing of its operations and development. The relevant liquidity require-

ments are the subject of management through the meticulous monitoring of debts of long term financial liabilities and also of payments

made on a daily basis.

On 31/12/2015, the positive balance between Group’s Working Capital and Short-Term Liabilities secures the adequate funding of the Par-

ent Company.

The Group ensures that there is sufficient available credit facilities to be able to cover its short-term business needs, after the calculation of

cash flows arising from the operation as well as cash and cash equivalents which are held. The funds for long-term liquidity needs ensured

by a sufficient amount of loanable funds and the ability to sell long-term financial assets.

The tables below summarize the maturity profile of the Group’s financial liabilities as at 31.12.2015 and 31.12.2014 respectively:

It must be noted that the above table does not include liabilities to

clients from the performance of construction projects, as the maturity

of such values cannot be assessed.

Moreover, cash-advances from customers, construction contacts li-

abilities as well as the provisions and accrued expenses are not in-

cluded.

Capital Control imposition in Greece

The Greek government and the Institutions, after almost five months

of negotiations, failed to reach an agreement until the extended Greek

program expired on the 30th of June 2015. During said period a con-

tinuous and escalated leak of bank deposits occurred as a result of

the increasing uncertainty. Said fact, along with the decision of the Eu-

ropean Central Bank (ECB) for no further increase in the Emergency

Liquidity Assistance (ELA), led to the Legislative Act (L.A.) of the 28th

of July 2015 that introduced the impose of capital controls along with

a Bank holiday period. With a later L.A. on the 18th of July 2015, the

Greek government decided the termination of the Bank holiday, but

retained the measure of capital controls.

The Group monitored and still does said developments very close-

ly, taking every necessary measure to safeguard its going concern.

Through the strength of its international profile and export orientation,

the Group copes with existing difficulties, supports the liquidity of the

Greek system and achieves a smooth and normal operation for all its

sectors of activity.

4.30 Fair Value Measurements

The following table presents financial assets and li-

abilities measured at fair value in the statement of fi-

nancial position in accordance with the fair value hi-

erarchy. This hierarchy groups financial assets and

liabilities into three levels based on the significance

of inputs used in measuring the fair value of the fi-

nancial assets and liabilities. The fair value hierarchy

has the following levels:

- Level 1: quoted prices (unadjusted) in active mar-

kets for identical assets or liabilities;

- Level 2: inputs other than quoted prices included

within Level 1 that are observable for the asset or li-

ability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices); and

- Level 3: inputs for the asset or liability that are not

based on observable market data (unobservable

inputs).

The level within which the financial asset or liability

is classified is determined based on the lowest level

of significant input to the fair value measurement.

The Group’s financial assets and liabilities meas-

ured at fair value in the statement of financial po-

sition are grouped into the fair value hierarchy for

31/12/2015 and 31/12/2014 as follows: