96

97

Annual Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

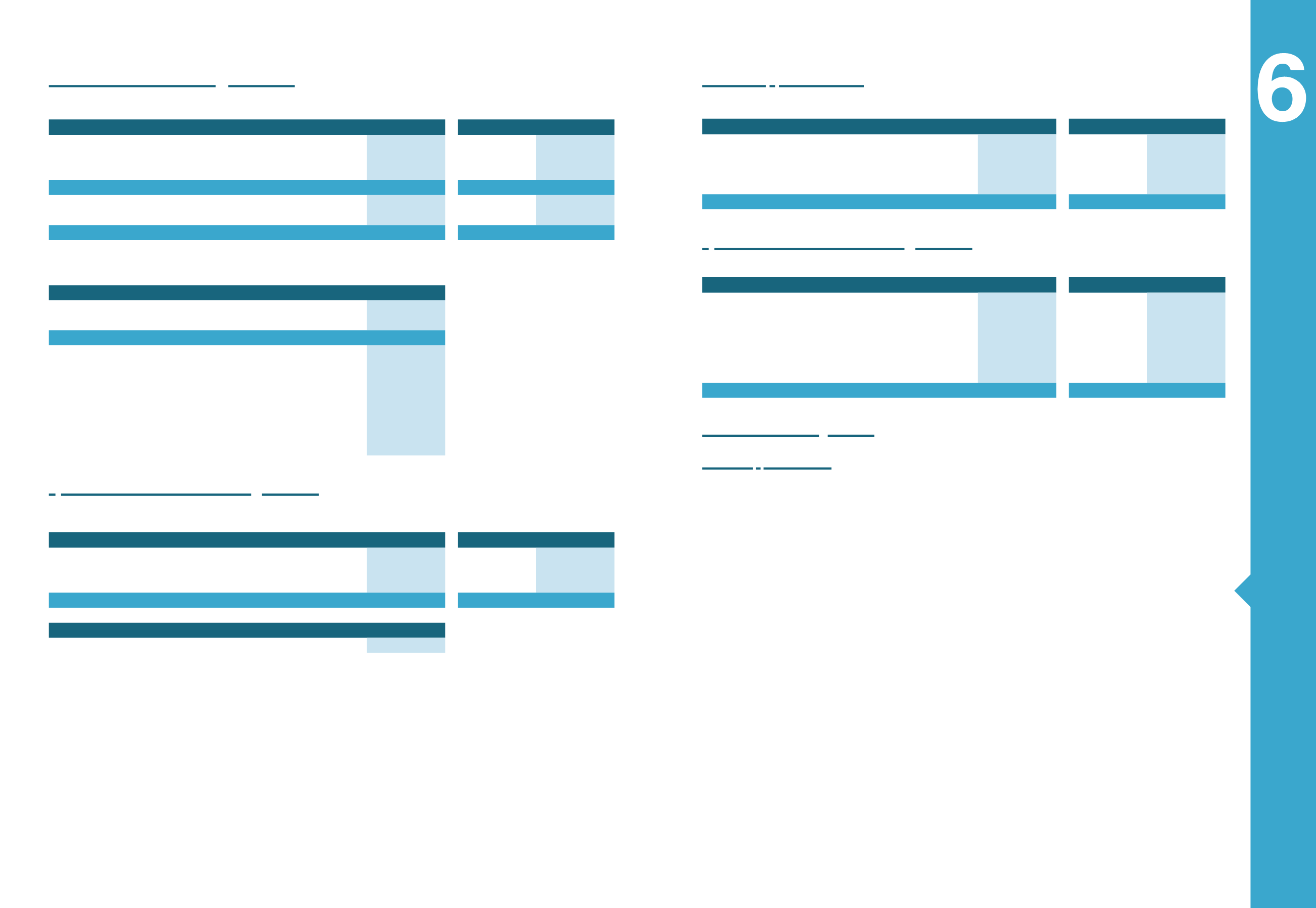

Customers

439,566

374,000

1,771

11,056

Checks receivable

4,377

4,283

1,917

1,917

Less: Impairment Provisions

(5,655)

(5,498)

(3,603)

(3,479)

Net trade Receivables

438,287

372,786

85

9,494

Advances for inventory purchases

171

139

-

-

Advances to trade creditors

31,556

34,093

-

-

Total

470,014

407,018

85

9,494

MYTILINEOS GROUP

Construction Contracts

31/12/2015

31/12/2014

Realised Contractual Cost & Profits (minus realised losses)

3,085,950

3,481,076

Less: Progress Billings

(3,016,865)

(3,600,636)

69,085

(119,560)

Receivables for construction contracts according to the

percentage of completion

270,706

63,130

Liabilities related to construction contracts according to

percent. of completion

(201,621)

(182,691)

Advances received

42,182

(47,303)

Clients holdings for good performance

104,641

120,018

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

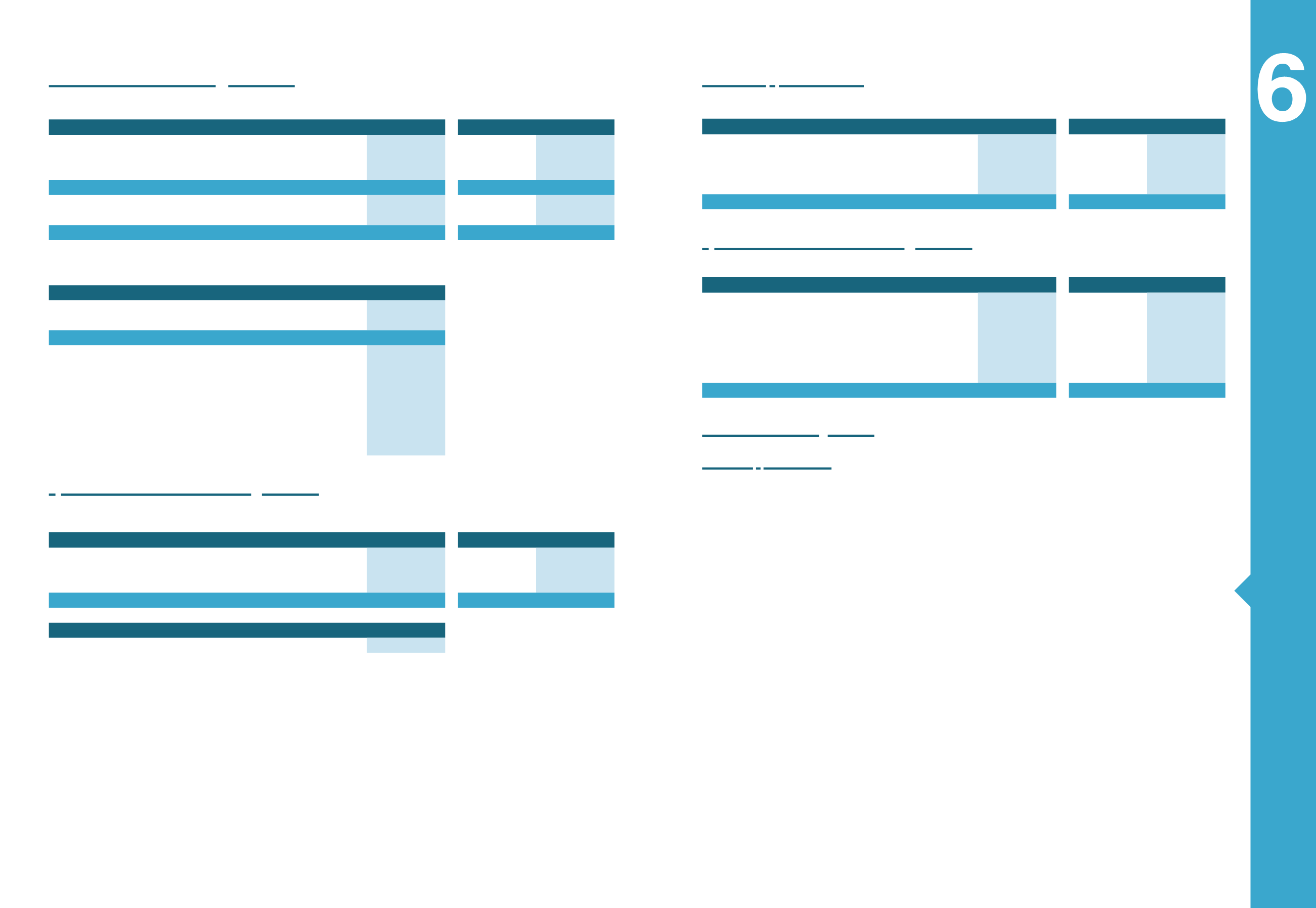

Cash

1,640

283

32

15

Bank deposits

115,640

92,290

1,217

771

Time deposits & Repos

83,579

220,855

-

-

Total

200,859

313,428

1,249

786

The weighted average interest rate is as:

31/12/2015

31/12/2014

Deposits in Euro

0.32%

1.61%

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Suppliers

305,295

268,316

17,994

13,645

Cheques Payable

-

3

-

-

Customers' Advances

61,277

34,678

-

1,710

Liabilities to customers for project implementation

200,719

182,136

-

-

Total

567,291

485,133

17,994

15,355

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Liabilities to Related Parties

2,882

1,336

116,913

123,984

Accrued expense

12,819

20,235

47

23

Social security insurance

3,503

3,346

191

177

Dividends payable

507

401

136

49

Deferred income-Grants

-

1,051

-

-

Others Liabilities

19,512

11,352

1,925

1,080

Total

39,224

37,720

119,212

125,314

4.9 Customers and other trade receivables

4.10 Cash and cash equivalents

4.11 Suppliers and other liabilities

4.12 Other short-term liabilities

4.13 Total Equity

4.13.1 Share capital

On 18 May 2015, the 1st Repeat Annual General Meeting of the Com-

pany’s Shareholders was held. With 60,816,650 valid votes cast rep-

resenting 52.02% of the paid-up share capital with right to vote, the

Meeting approved unanimously Item 4 on the original Agenda con-

cerning the decrease of the Company’s share capital by the amount

of eleven million six hundred and ninety-one thousand five hundred

and eighty-six euro and twenty cents (

€

11,691,586.20) by means of a

decrease of the nominal value of each share from one euro and seven

cents (

€

1.07) to ninety-seven eurocents (

€

0.97), with reimbursement

to the shareholders of the amount of the decrease in the sum of ten

eurocents (

€

0.10) per share, and the amendment of article 5 of the

Company’s Articles of Association accordingly.

On 09.06.2015, Decision no. 62296/09.06.2015 of the Ministry of

Economy, Infrastructure, Shipping & Tourism (ΑΔΑ: ΩΔΓΜ465ΦΘΘ-

ΔΓΡ), approving the amendment of article 5 of the Company’s Articles

of Association, was registered with the General Commercial Regis-

ter (GEMI), under Registration Number 370695. The Stock Markets

Steering Committee, in its meeting of 15/10/2015, was informed of the

decrease as above of the nominal value of the Company’s shares and

of the reimbursement of capital by payment to the shareholders of the

amount of ten eurocents (

€

0.10) per share.

Following the above, as of 19/10/2015 the Compa-

ny’s shares were traded in the Athens Exchange at

the new nominal value of Euro 0.97 per share and

without the right to participate in the reimbursement

of capital by means of payment to the shareholders

of the amount of ten eurocents (

€

0.10) per share. As

of the same date, the starting price of the Compa-

ny’s shares in the Athens Exchange was determined

in accordance with the Athens Exchange Rule Book,

in combination with Decision no. 26 of the ATHEX

Board of Directors, as in force. The beneficiaries en-

titled to the capital return in the form of payments in

the sum of Euro 0.10 per share were the persons

registered as shareholders in the Dematerialised

Securities System (DSS) on 20/10/2015.

The capital return was settled on the 23/10/2015.