98

99

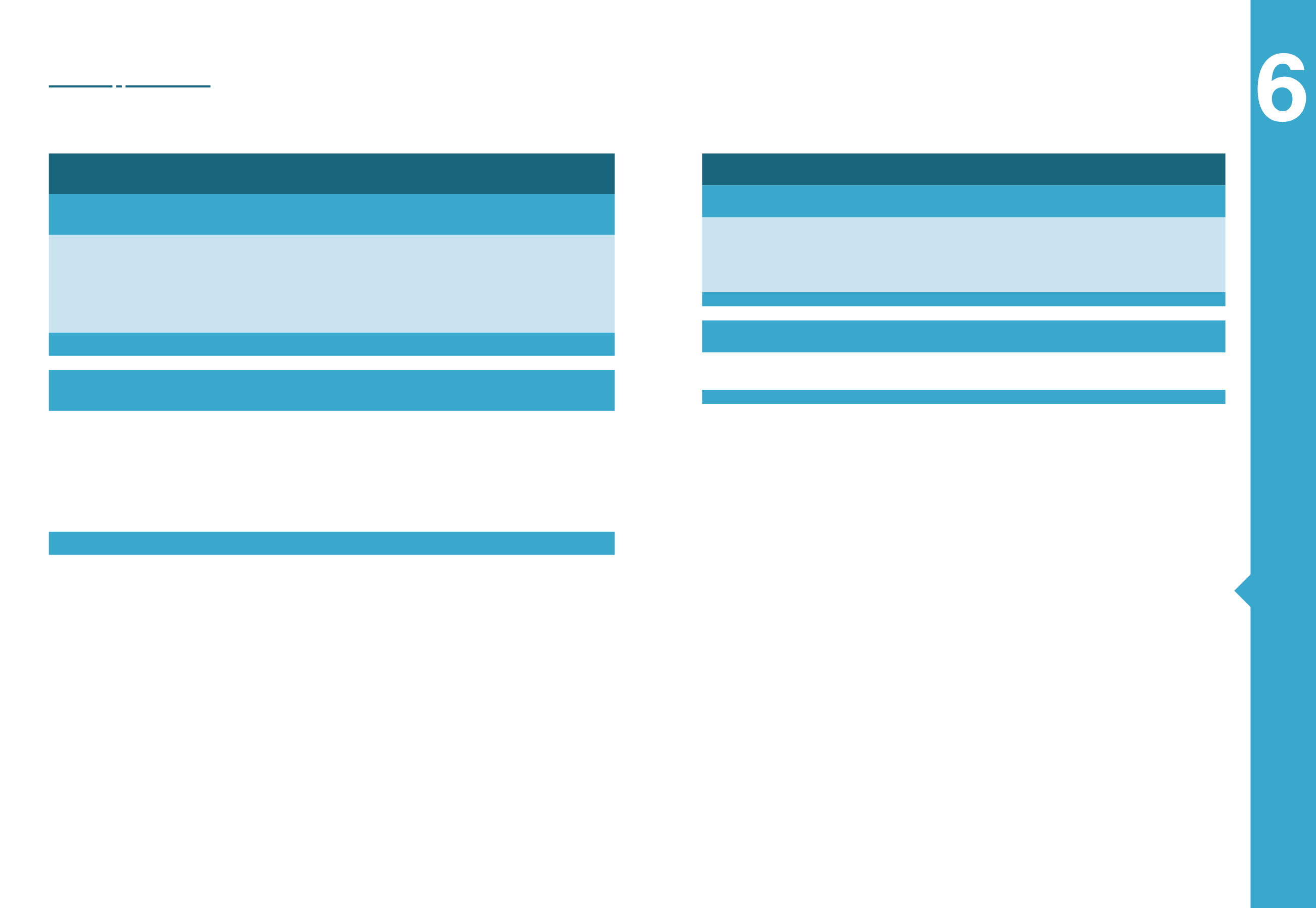

Annual Financial Statements

MYTILINEOS GROUP

(Amounts in thousands

€

)

Regular

Reserve

Special &

Extraordinary

Reserves

Tax-free and

Specially taxed

Reserves

Revaluation

reserves

Financial

instruments

valuation

reserve

Stock Option Plan

Reserve

Actuarial Gain/

Losses Reserve Total

Opening Balance

1st January 2014,

according to IFRS -as

published-

20,816

36,091

81,127

221

(285)

1,225

1,348 140,542

Transfer To Reserves

(249)

(25,771)

(3,651)

-

(2,707)

-

6

(32,371)

Impact From Transfer Of

Subsidiary

(1,027)

(1,796)

-

-

-

-

(13)

(2,836)

Cash Flow Hedging

Reserve

-

19

(1,356)

-

417

-

(78)

(998)

Deferred Tax From

Actuarial Gain / (Losses)

-

-

-

-

-

-

90

90

Actuarial Gain / (Losses)

-

-

-

-

-

-

(2,442)

(2,442)

Closing Balance

31/12/2014

19,541

8,542

76,120

221

(2,575)

1,225

(1,089) 101,984

Opening Balance

1st January 2015,

according to IFRS -as

published-

19,541

8,542

76,120

221

(2,575)

1,225

(1,089) 101,984

Transfer To Reserves

222

(3)

(946)

51

2,977

-

-

2,300

Impact From Transfer Of

Subsidiary

-

1

-

-

-

-

-

1

Cash Flow Hedging

Reserve

-

-

12

-

(782)

-

-

(770)

Deferred Tax From

Actuarial Gain / (Losses)

-

-

-

-

-

-

119

119

Actuarial Gain / (Losses)

-

-

-

-

-

-

(767)

(767)

Deferred Tax From Cash

Flow Hedging Reserve

-

-

-

-

688

-

-

688

Closing Balance

31/12/2015

19,763

8,540

75,186

271

309

1,225

(1,737) 103,557

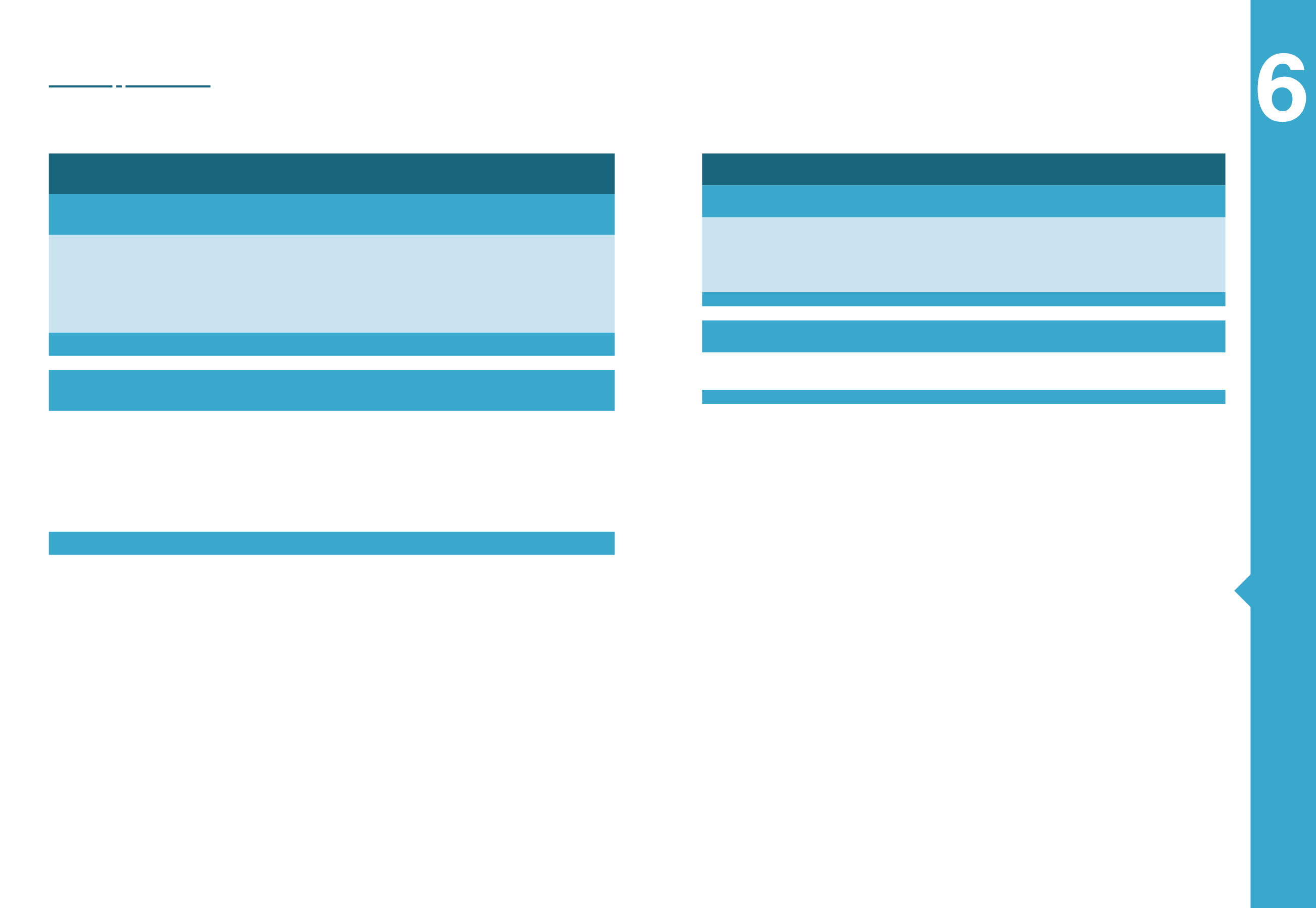

MYTILINEOS S.A.

(Amounts in thousands

€

)

Regular

Reserve

Special &

Extraordinary

Reserves

Tax-free and

Specially taxed

Reserves

Revaluation

reserves

Stock Option

Plan Reserve

Actuarial Gain/

Losses Reserve Total

Opening Balance 1st January

2014, according to IFRS -as

published-

55,572

25,112

(66,006)

172

1,225

(46) 16,029

Transfer To Reserves

-

(25,183)

(4,440)

-

-

- (29,622)

Impact From Merge Through

Acquisition Of Subsidiary

-

17,060

-

-

73

(4)

17,129

Deferred Tax From Actuarial Gain /

(Losses)

-

-

-

-

-

19

19

Actuarial Gain / (Losses)

-

-

-

-

-

(68)

(68)

Closing Balance 31/12/2014

55,572

16,989

(70,446)

172

1,298

(99)

3,486

Opening Balance 1st January

2015, according to IFRS -as

published-

55,572

16,989

(70,446)

172

1,298

(99)

3,486

Deferred Tax From Actuarial Gain /

(Losses)

-

-

-

-

-

(4)

(4)

Actuarial Gain / (Losses)

-

-

-

-

-

14

14

Closing Balance 31/12/2015

55,572

16,989

(70,446)

172

1,298

(89)

3,496

4.13.2 Reserves

Reserves in the financial statements are analysed as follows:

The majority of the above reserves relates to Parent Company and Greek subsidiaries. Under Greek corporate law, corporations

are required to transfer a minimum of 5% of their annual net profit as reflected in their statutory books to a legal reserve, until

such reserve equals one-third of the outstanding share capital. The above reserve cannot be distributed throughout the life of

the company.

Tax free reserves represent non distributed profits that are exempt from income tax based on special provisions of development

laws (under the condition that adequate profits exist for their allowance). These reserves mainly relate to investments and are not

distributed.

Specially taxed reserves represent interest income and income from disposal of listed in the Stock Exchange and non listed

companies and are tax free or tax has been withheld at source. Except for any tax prepayments, these reserves are exempted

from taxes, provided they are not distributed to shareholders.