110

111

Annual Financial Statements

4.29.2 Credit Risk

The Group has no significant concentrations of credit risk with any single counter party. Credit risk arises from cash and cash

equivalents, derivative financial instruments and deposits with banks and financial institutions, as well as credit exposures to

wholesale customers.

Concerning trade accounts receivables, the Group is not exposed to significant credit risks as they mainly consist of a large,

widespread customer base. However, the atypical conditions that dominate the Greek market and several other markets in Eu-

rope are forcing the Group to constantly monitor its business claims and also to adopt policies and practices to ensure that such

claims are collected. By way of example, such policies and practices include insuring credits where possible; pre-collection of

the value of product sold to a considerable degree; safeguarding claims by collateral loans on customer reserves; and receiving

letters of guarantee.

To minimize credit risk on cash reserves and cash equivalents; in financial derivate contracts; as well as other short term financial

products, the Group specifies certain limits to its exposure on each individual financial institution and only engages in transac-

tions with creditworthy financial institutions of high credit rating.

The tables below summarize the maturity profile of the Group’s financial assets as at 31.12.2015 and 31.12.2014 respectively:

4.29 Financial Risk Factors

The Group’s activities expose it to a variety of financial risks: market risk (includ-

ing foreign exchange risk and price risk), credit risk, liquidity risk, cash flow risk

and fair value interest-rate risk. The Group’s overall risk management program

focuses on the unpredictability of commodity and financial markets and seeks

to minimize potential adverse effects on the Group’s financial performance. The

Group uses derivative financial instruments to hedge the exposure to certain fi-

nancial risks.

Risk management is carried out by a central treasury department (Group Treas-

ury) under policies approved by the Board of Directors. Group Treasury operates

as a cost and service centre and provides services to all business units within the

Group, co-ordinates access to both domestic and international financial markets

and manages the financial risks relating to the Group’s operations. This includes

identifying, evaluating and if necessary, hedging financial risks in close co-oper-

ation with the various business units within the Group.

4.29.1 Market Risk

(i) Foreign Exchange Risk

The Group is activated in a global level and consequently is exposed to foreign

exchange risk emanating mainly from the US dollar. This kind of risk mainly re-

sults from commercial transactions in foreign currency as well as net investments

in foreign entities. For managing this type of risk, the Group Treasury Department

enters into derivative or non derivative financial instruments with financial institu-

tions on behalf and in the name of group companies.

In Group level these financial instruments are characterized as exchange rate risk

hedges for certain assets, liabilities or foreseen commercial transactions.

(ii) Price Risk

The Group’s earnings are exposed to movements in the prices of the commodi-

ties it produces, which are determined by the international markets and the global

demand and supply.

The Group is price risk from fluctuations in the prices of variables that determine

either the sales and/or the cost of sales of the group entities (i.e. products’ prices

(LME), raw materials, other cost elements etc.). The Group’s activities expose it

to the fluctuations of the prices of Aluminium (AL), Zinc (Zn), Lead (Pb) as well as

to Fuel Oil as a production cost.

Commodity price risk can be reduced through the negotiation of long term con-

tracts or through the use of financial derivatives.

(iii) Interest rate risk.

Group’s interest bearing assets comprises only of cash and cash equivalents.

Additionally, the Group maintains its total bank debt in products of floating in-

terest rate. In respect of its exposure to floating interest payments, the Group

evaluates the respective risks and where deemed necessary considers the use

of appropriate interest rate derivatives. The policy of the Group is to minimize

interest rate cash flow risk exposures on long-term financing.

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Until 1 year

3,380

3,028

292

265

1 to 5 years

11,824

10,945

1,014

1,006

> 5 years

12,733

14,433

332

349

Total Operating Lease

27,936

28,407

1,639

1,621

4.28 Operating Leases

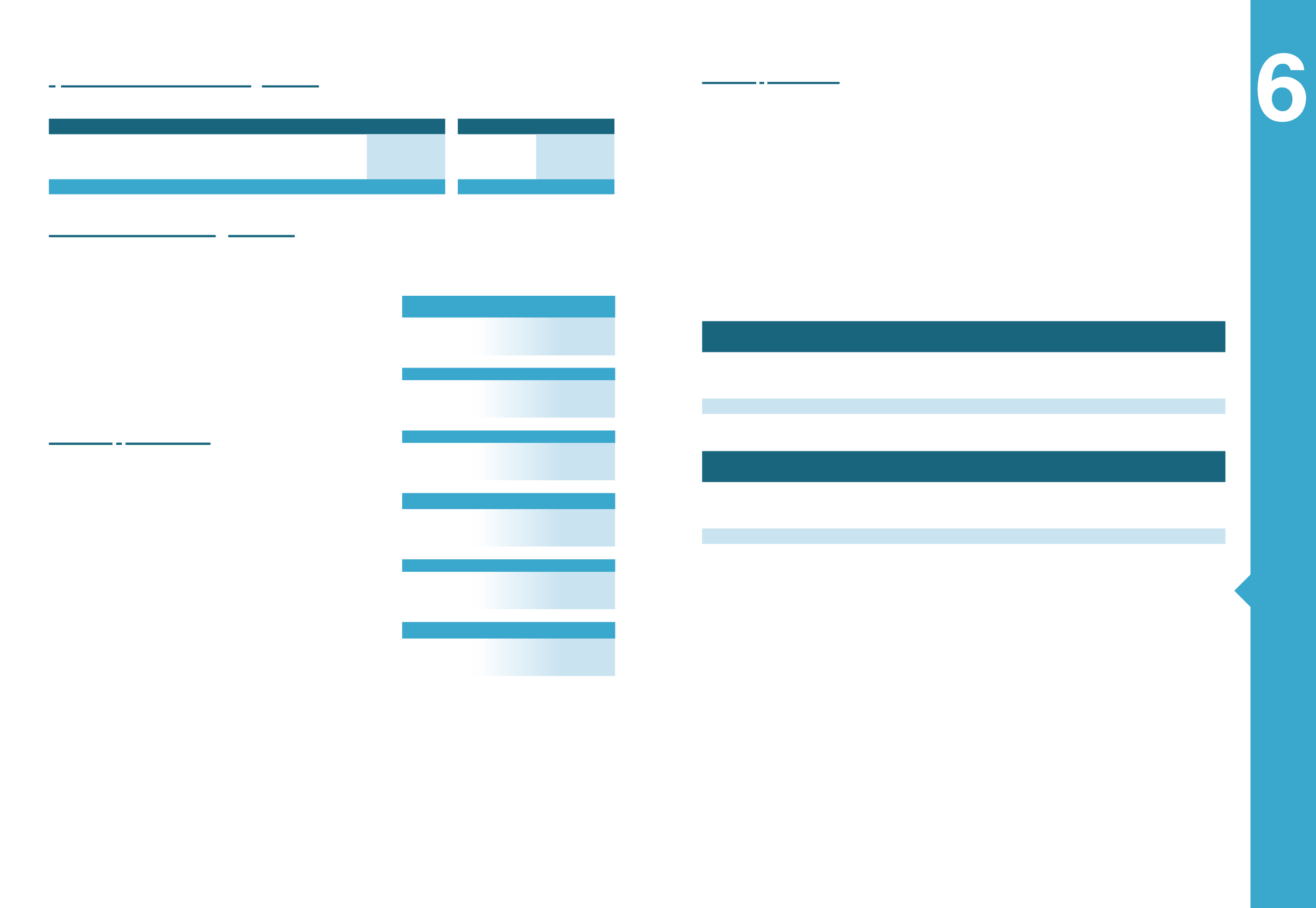

Effects and Sensitivity Analysis

The effects of the above risks at the Group’s operat-

ing results, equity, and net profitability are presented

in the table below:

LME AL (Aluminium)

$/t

+ 50 - 50

EBITDA

m.

€

9,0

-9,0

Net Profit

m.

€

9,0

-9,0

Equity

m.

€

9,0

-9,0

LME Pb (Lead)

$/t

+ 50 -50

EBITDA

m.

€

0,1

-0,1

Net Profit

m.

€

0,1

-0,1

Equity

m.

€

0,1

-0,1

LME Zn (Zinc)

$/t

+ 50 -50

EBITDA

m.

€

0,1

-0,1

Net Profit

m.

€

0,1

-0,1

Equity

m.

€

0,1

-0,1

Exchange Rate

€

/$

€

/$ - 0,05 +

0,05

EBITDA

m.

€

15,9 -15,9

Net Profit

m.

€

15,9 -15,9

Equity

m.

€

15,6 -15,6

BRENT

$/t

- 50 + 50

EBITDA

m.

€

0,3

-0,3

Net Profit

m.

€

0,3

-0,3

Equity

m.

€

0,3

-0,3

NG Price

€

/

MWh - 5 + 5

EBITDA

m.

€

9,0

-9,0

Net Profit

m.

€

9,0

-9,0

Equity

m.

€

9,0

-9,0

It is noted that an increase of five (5) basis points

presume a decrease of 3.53 mil.

€

on net results and

Equity.

The Group’s exposure in price risk and therefore

sensitivity may vary according to the transaction

volume and the price level. However, the above

sensitivity analysis is representative for the Group

exposure in 2015.

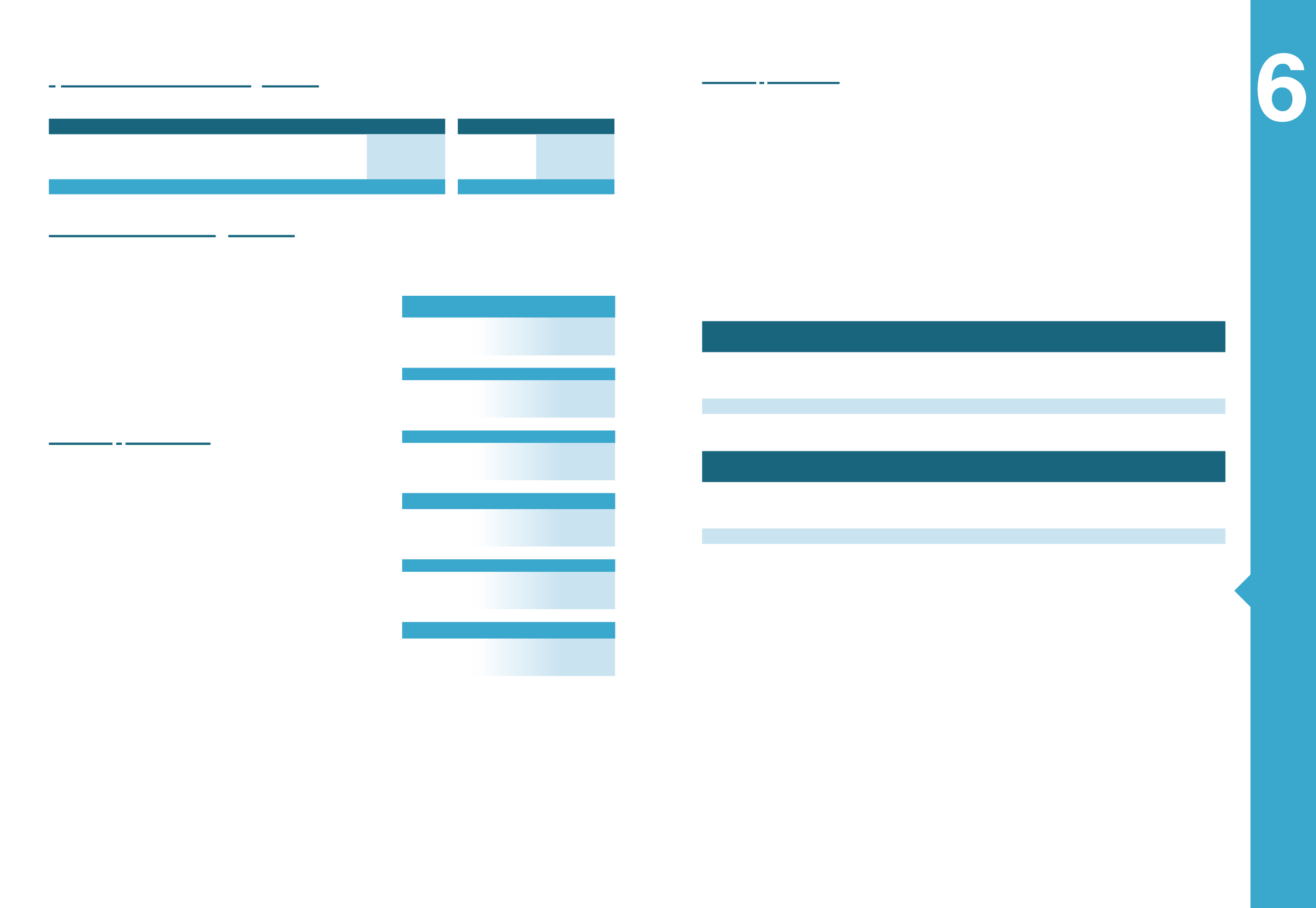

MYTILINEOS GROUP

Past due but not impaired

Non past due but not

impaired

Total

(Amounts in thousands

€

)

0-3 months 3-6 months

6-12 months

> 1 year

Liquidity Risk Analysis -

Trade Receivables

2015

51,398

15,765

3,301

31,588

367,963

470,014

2014

37,270

8,761

2,413

130,854

227,720

407,018

MYTILINEOS S.A.

Past due but not impaired

Non past due but not

impaired

Total

(Amounts in thousands

€

)

0-3 months 3-6 months

6-12 months

> 1 year

Liquidity Risk Analysis -

Trade Receivables

2015

-

85

-

-

-

85

2014

491

-

-

-

9,003

9,494