92

93

Annual Financial Statements

MYTILINEOS GROUP

(Amounts in thousands

€

)

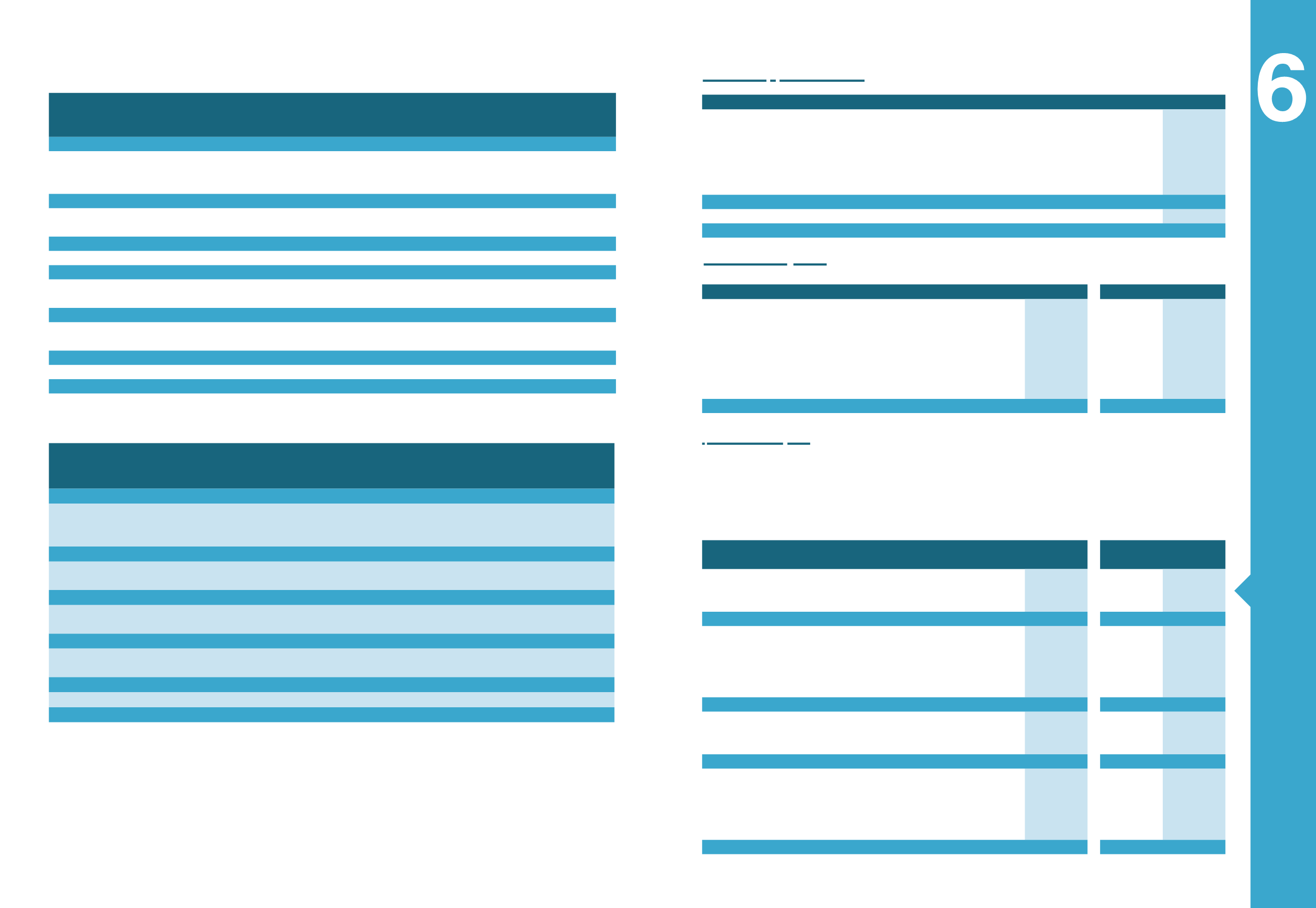

31/12/2015 31/12/2014

Raw materials

136,754

59,729

Semi-finished products

1,260

907

Finished products

19,157

23,325

Work in Progress

31,565

31,029

Merchandise

5,625

1,610

Others

47,347

38,118

Total

241,708

154,719

(Less)Provisions for scrap, slow moving and/or destroyed inventories:

(2,432)

(2,432)

Total Stock

239,276

152,287

MYTILINEOS S.A.

1/1/2015

31/12/2015

(Amounts in thousands

€

)

At 1st January

Recognised In Profit

Or Loss

Recognised In Other

Comprehensive

Income

As At 31 December

Deferred Tax Asset Deferred Tax Liability

Non - Current Assets

Intangible Assets

730

(11)

-

720

720

-

Tangible Assets

(1,089)

(137)

-

(1,226)

-

(1,226)

Investment to subsidiaries

(3)

(29,521)

-

(29,524)

-

(29,524)

Current Assets

Receivables

15,600

(4,800)

-

10,800

10,800

-

Financial Assets at fair value

(22)

64

-

42

42

-

Reserves

Actuarial Gain/Losses

-

19

(4)

15

15

-

Long-term Liabilities

Employee Benefits

58

(10)

-

49

49

-

Long-ΤermLoans

(363)

332

-

(30)

-

(30)

Short-Term Liabilities

Provisions

(4,146)

6,471

-

2,325

1,045

1,281

Other Contingent Defer Taxes

(34,791)

34,791

-

-

-

-

Total

(24,023)

7,199

(4)

(16,830)

12,671

(29,499)

Deferred Tax From Tax Losses

5,004

(5,004)

-

-

-

-

Deferred Tax (Liability)/Receivables

(19,020)

2,194

(4)

(16,830)

12,670

(29,500)

MYTILINEOS S.A.

1/1/2014

31/12/2014

(Amounts in thousands

€

)

At 1st January

Recognised In

Profit Or Loss

Recognised In Other

Comprehensive

Income

Deferred Tax Impact

From Disposal Of

Subsidiary

As At 31

December

Deferred Tax

Asset

Deferred Tax

Liability

Non - Current Assets

Intangible Assets

824

(93)

-

(1)

730

730

-

Tangible Assets

(1,078)

(11)

-

-

(1,089)

-

(1,089)

Investment to subsidiaries

3,457

(8,885)

-

5,425

(3)

(3)

-

Current Assets

Receivables

-

13,444

-

2,156

15,600

15,600

-

Financial Assets at fair value

17

(39)

-

-

(22)

(22)

-

Long-term Liabilities

Employee Benefits

50

(10)

19

-

58

58

-

Long-ΤermLoans

-

(363)

-

-

(363)

-

(363)

Short-Term Liabilities

Provisions

(468)

(1,540)

-

(2,137)

(4,146)

867

(5,013)

Other Contingent Defer Taxes

(34,791)

-

-

-

(34,791)

-

(34,791)

Total

(31,990)

2,504

19

5,443

(24,023)

17,231

(41,255)

Deferred Tax From Tax Losses

5,004

-

-

-

5,004

5,004

-

Deferred Tax (Liability)/Receivables

(26,986)

2,504

19

5,443

(19,020)

22,235

(41,255)

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015 31/12/2014

31/12/2015 31/12/2014

Other Debtors

60,441

43,594

87

48

Receivables from the State

65,060

59,787

3,135

1,962

Receivables from Subsidiaries

(89)

288

40,212

321

Loans given to Subsidiaries

-

255

-

-

Accrued income - Prepaid expenses

25,468

8,336

-

-

Prepaid expenses for construction contracts

7

(891)

-

-

Less: Provision for Bad Debts

899

-

-

-

Total

149,988

111,369

43,434

2,332

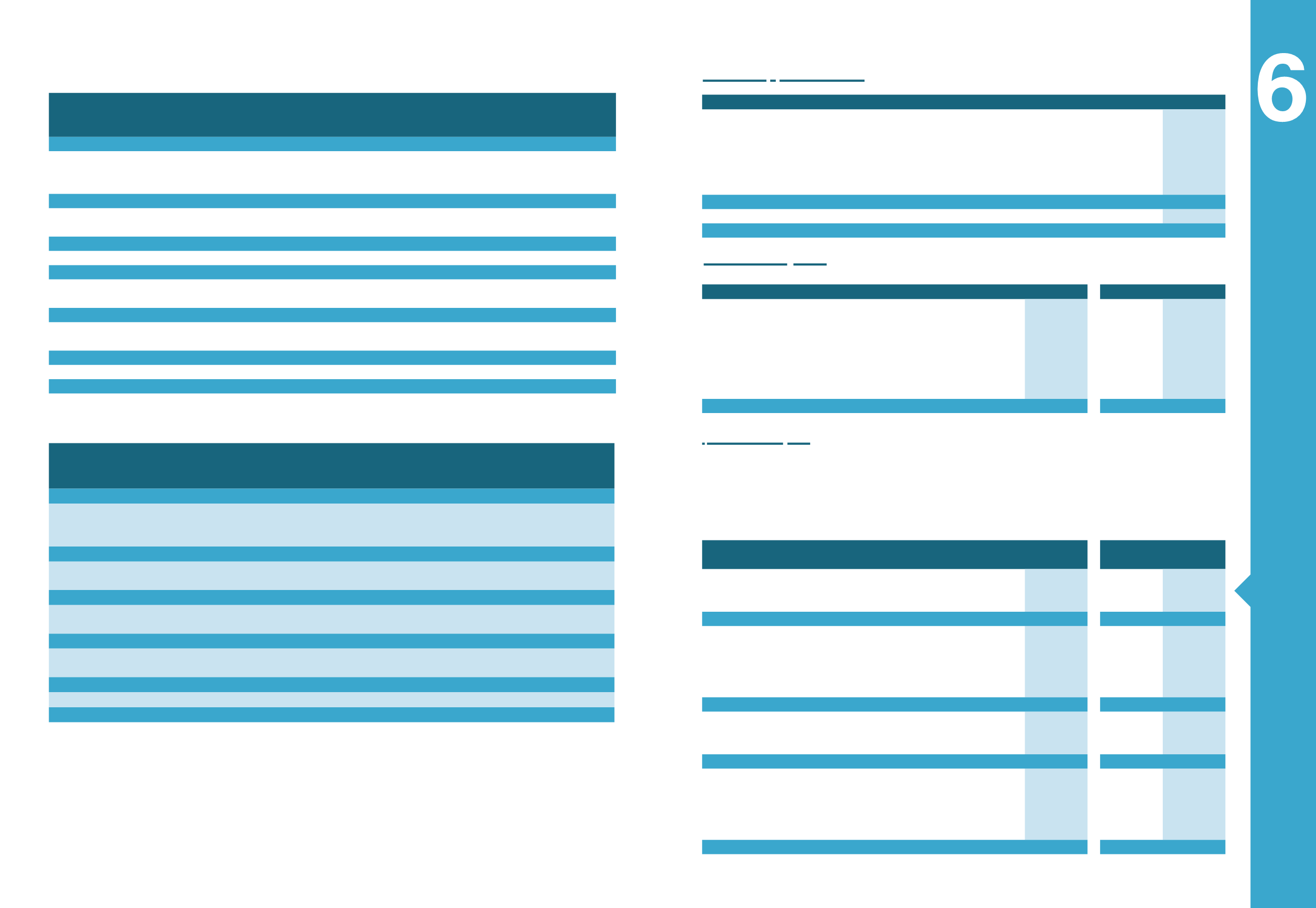

MYTILINEOS GROUP

MYTILINEOS S.A.

31/12/2015 31/12/2014

31/12/2015 31/12/2014

(Amounts in thousands

€

)

Non current assets

-

-

-

-

Financial Assets Available for Sale

2,253

507

112

112

Other Long-term Receivables

220,092

79,069

175

173

Total

222,344

79,575

287

284

Current assets

-

-

-

-

Derivatives

-

555

-

-

Financial assets at fair value through profit or loss

1,077

3,080

150

581

Trade and other receivables

620,002

518,387

43,519

11,825

Cash and cash equivalents

200,859

313,428

1,249

786

Total

821,939

835,450

44,918

13,193

Non-Current Liabilities

-

-

-

-

Long-term debt

404,278

524,023

-

151,981

Other long-term liabilities

90,545

72,467

28,493

35,598

Total

494,822

596,489

28,493

187,579

Current Liabilities

-

-

-

-

Short-term debt

166,023

120,748

17,245

3,832

Current portion of non-current liabilities

157,235

42,090

7,130

9,167

Derivatives

3,392

4,949

-

-

Trade and other payables

606,515

522,853

137,206

140,669

Total

933,164

690,641

161,581

153,668

4.6 Inventories

4.7 Other receivables

4.8 Financial assets & liabilities

The Group’s financial instruments consist mainly of deposits with banks, bank overdrafts, FX spot and forwards, trade accounts

receivable and payable, loans to and from subsidiaries, associates, joint ventures, investments in bonds, dividends payable and

lease obligations.

The financial instruments presented in the financial statements are categorized in the tables below: