94

95

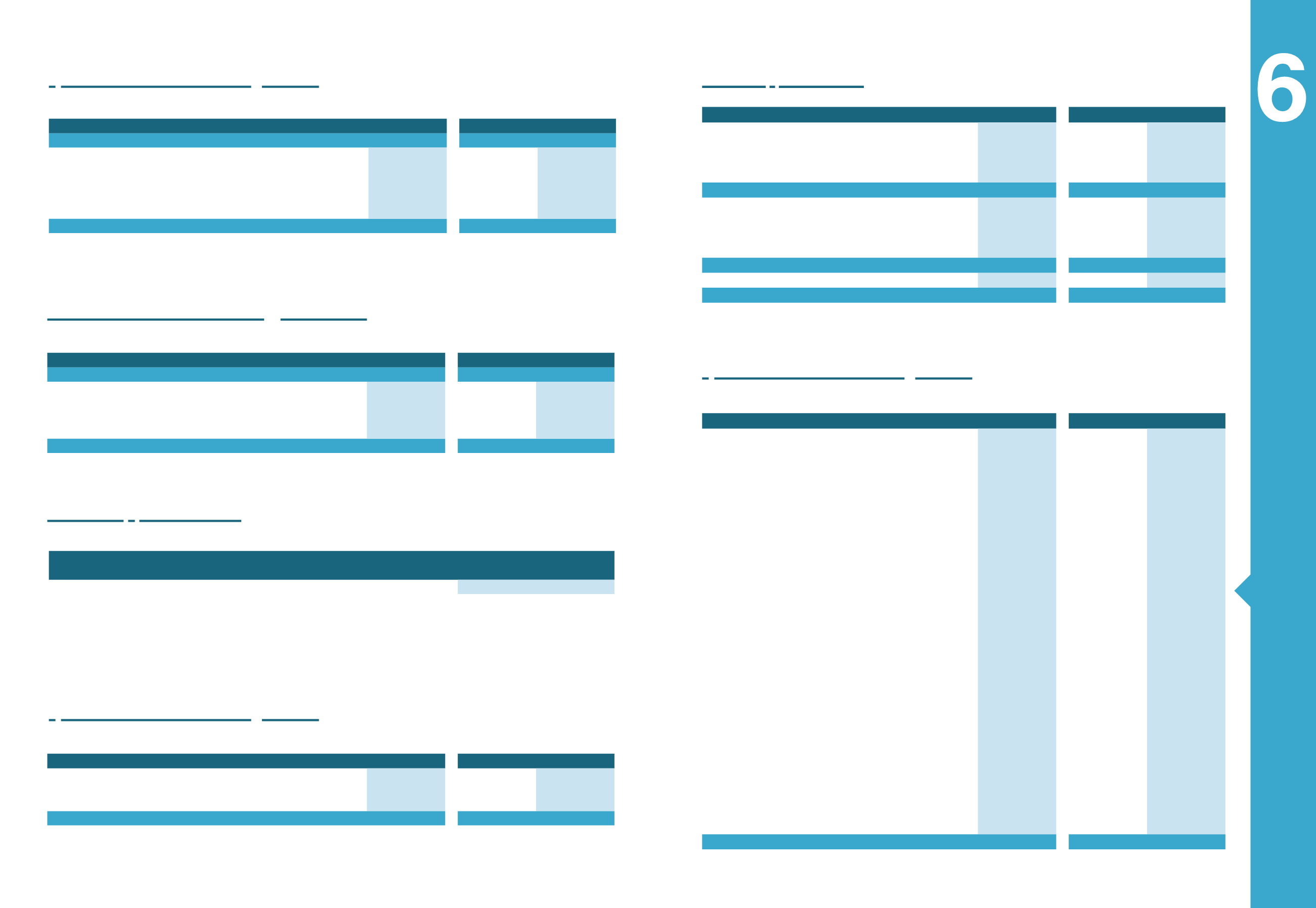

Annual Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Total Opening

3,080

1,598

581

431

Additions

6,832

18,721

-

-

Sales

(8,871)

(15,967)

(540)

-

Fair Value Adjustments

36

(1,311)

109

150

Exchange Rate Differences

-

40

-

-

Closing Balance

1,077

3,080

150

581

MYTILINEOS GROUP

31/12/2015

31/12/2014

(Amounts in thousands

€

)

Asset

Liability

Asset

Liability

Derivatives

-

3,392

555

4,949

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Customers - Withholding quarantees falling due after one year

213,511

72,142

-

-

Given Guarantees

1,498

1,313

175

173

Other long term receivables

5,084

5,613

-

-

Other Long-term Receivables

220,092

79,069

175

173

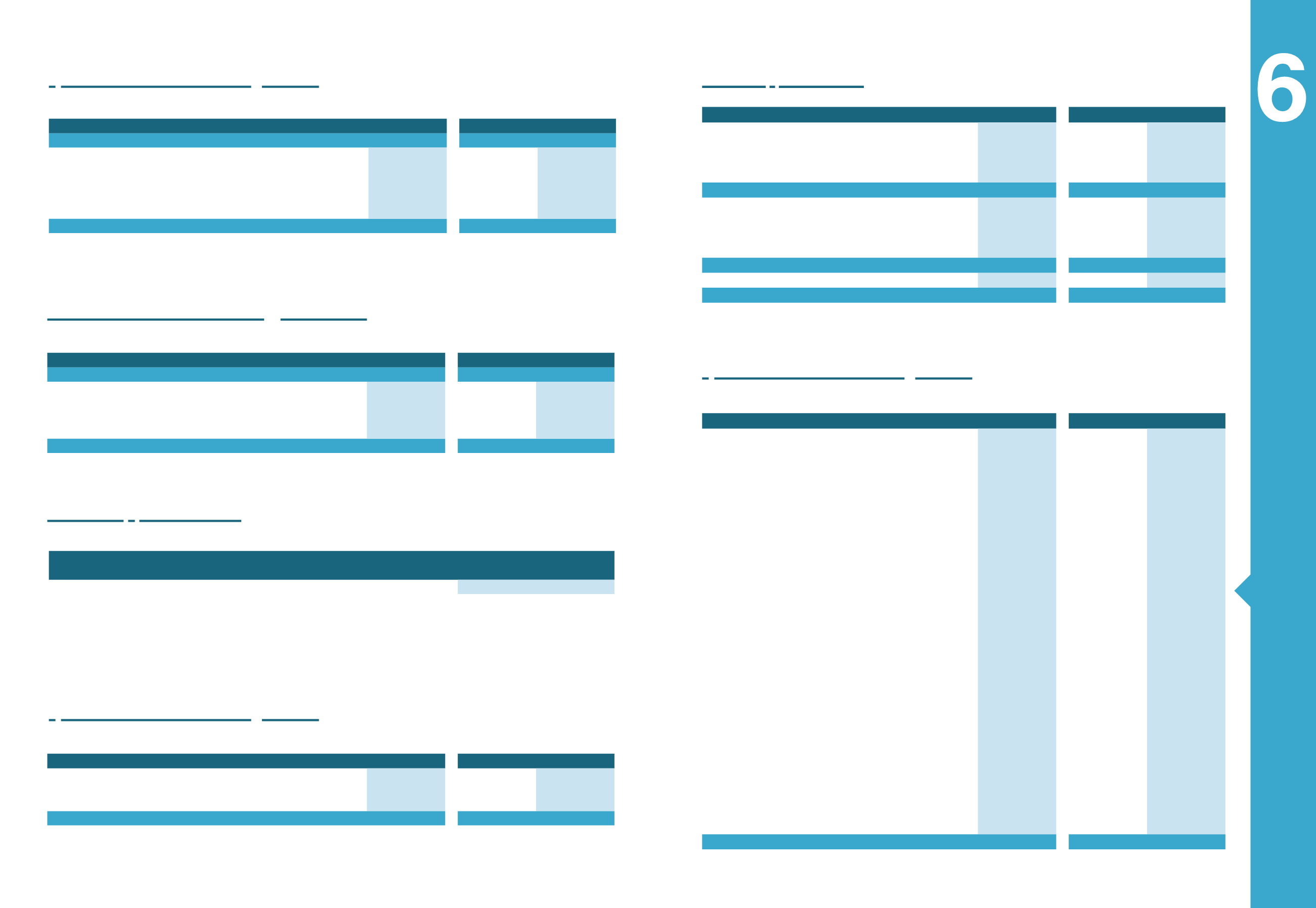

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Long-term debt

Bank loans

2,278

2,179

-

-

Bonds

402,000

521,770

-

151,981

Other

-

74

-

-

Total

404,278

524,023

-

151,981

Short-term debt

Overdraft

64,402

48,974

17,245

3,832

Bank loans

46,620

56,774

-

-

Bonds

55,000

15,000

-

-

Total

166,023

120,748

17,245

3,832

Current portion of non-current liabilities

157,235

42,090

7,130

9,167

Total

727,536

686,861

24,375

164,980

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Received guarantees - Grants-Leasing

Total Opening

34,116

37,743

-

-

Additions

599

-

-

-

Transfer At Profits/Loss

(502)

-

-

-

Transfer From / (To) Short - Term

(690)

(3,627)

-

-

Closing Balance

33,523

34,116

-

-

Advances of customers

Total Opening

24,413

11,261

-

-

Additions

10,836

61,558

-

-

Transfer At Profits/Loss

-

-

-

-

Transfer From / (To) Short - Term

(27,419)

(48,406)

-

-

Closing Balance

7,830

24,413

-

-

Other

Total Opening

164

101,267

35,598

37,347

Additions

-

(48,480)

-

-

Transfer From / (To) Short - Term

-

(52,437)

(7,105)

(1,749)

Discont. Operations / Sales Of Subsidiary

-

(189)

-

-

Exchange Rate Differences

1

2

-

-

Closing Balance

165

164

28,493

35,598

Suppliers holdings for good performance

Total Opening

13,773

-

-

-

Additions

40,002

16,993

-

-

Transfer From / (To) Short - Term

(4,750)

(3,220)

-

-

Closing Balance

49,026

13,773

-

-

Total

90,545

72,467

28,493

35,598

4.8.2 Financial assets at fair value through profit or loss

4.8.3 Derivatives financial instruments

All derivatives open positions have been marked to market. Fair values of the “interest rate swaps”, are confirmed by the financial institu-

tions that the Group has as counterparties.

The Group manages the exposure to currency risk through the use of currency forwards and options and thus by “locking” at exchange

rates that provide sufficient cash flows and profit margins. Furthermore, the Group manages the exposure to commodity risk through the

use of: a) commodity futures that hedge the risk from the change at fair value of commodities and b) commodity swaps that hedge fluctua-

tions in cash flows from the volatility in aluminum prices.

4.8.4 Other long-term receivables

4.8.5 Loan liabilities

The effective weighted average borrowing rate for the group, as at the balance sheet date is 5,44%.

During the reporting period 2015 the Group proceeded with restructuring of existing borrowings in order to extent

maturity.

4.8.6 Other long-term liabilities

4.8.1 Financial Assets available for sale

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

31/12/2015

31/12/2014

31/12/2015

31/12/2014

Total Opening

507

1,200

112

37

Other Additions

108

-

-

75

Sale Of Investment

-

(1)

-

-

Valuation Of Treasury Shares At Fair Value

1,619

-

-

-

Other Changes

(22)

(836)

-

-

Exchange Rate Differences

42

144

-

-

Closing Balance

2,253

507

112

112