108

109

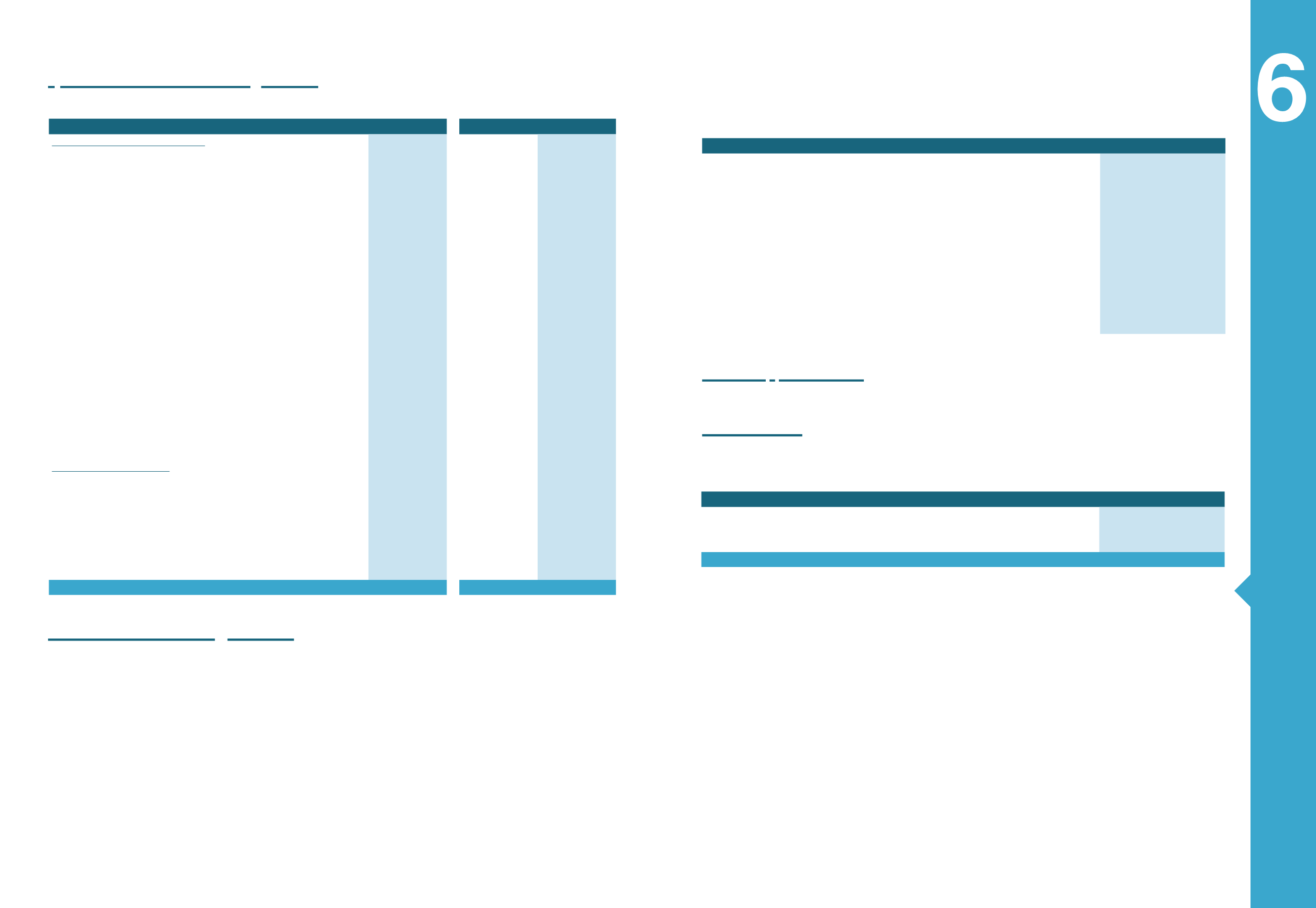

Annual Financial Statements

MYTILINEOS GROUP

MYTILINEOS S.A.

(Amounts in thousands

€

)

1/1-31/12/2015 1/1-31/12/2014

1/1-31/12/2015 1/1-31/12/2014

Cash flows from operating activities

Profit for the period

80,412

113,667

(271)

(2,224)

Adjustments for:

Tax

28,379

22,643

(1,434)

(2,504)

Depreciation of property,plant and equipment

55,714

52,789

312

323

Depreciation of intangible assets

6,098

6,847

33

61

Impairments

42

1,970

42

-

Provisions

147

(3,486)

683

-

Income from reversal of prior year's provisions

(1,198)

(118)

(1,140)

-

Profit/Loss from sale of tangible assets

174

(137)

-

2

Profit/Loss from fair value valuation of investment property

(48)

3,075

-

-

Profit/Loss from fair value valuation of financ.assets at fair

value through PnL

(1,694)

1,988

(109)

(150)

Profit/Loss from sale of financial assets at fair value

4,267

(5,894)

-

-

Interest income

(3,005)

(9,171)

(52)

(102)

Interest expenses

54,563

60,438

15,441

20,118

Dividends

-

(4)

(16,080)

(7,797)

Grants amortization

(1,741)

(2,576)

-

-

Parent company's portion to the profit of associates

(197)

191

-

-

Exchange differences

(3,763)

(16,662)

2,889

(3,155)

Other differences

(508)

(12)

-

-

137,230

111,880

584

6,796

Changes in Working Capital

(Increase)/Decrease in stocks

(81,131)

(24,897)

-

-

(Increase)/Decrease in trade receivables

(102,918)

146,189

10,657

14,399

(Increase)/Decrease in other receivables

(1,661)

(450)

-

-

Increase / (Decrease) in liabilities

(40,677)

(104,892)

(15,800)

(15,621)

Provisions

(23)

6

-

-

Pension plans

(591)

(1,627)

(6)

34

(227,002)

14,330

(5,150)

(1,189)

Cash flows from operating activities

(9,360)

239,878

(4,837)

3,384

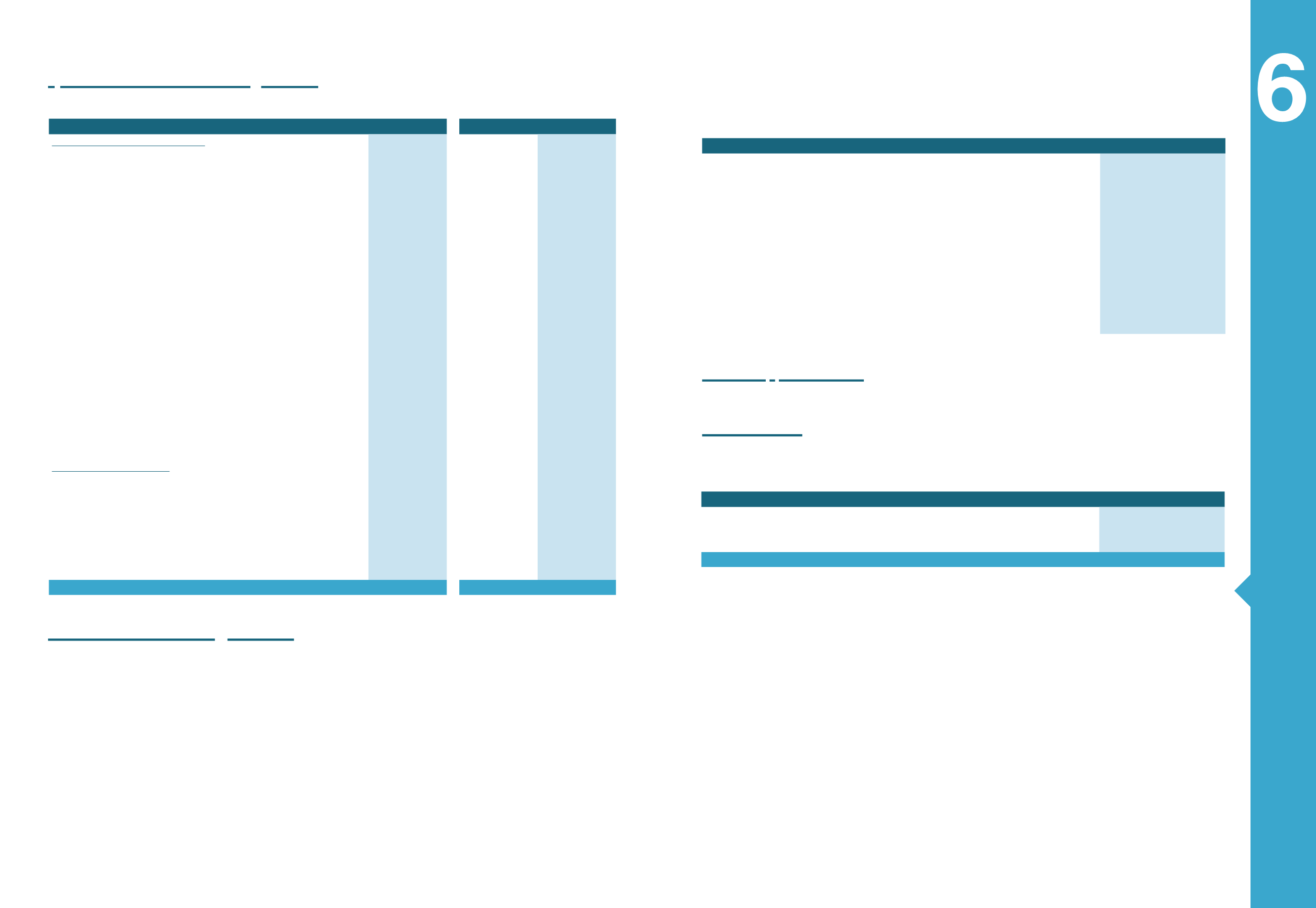

(Amounts in thousands

€

)

1/1-31/12/2015

1/1-31/12/2014

Sales

4,004

7,713

Cost of sales

(5,577)

(5,406)

Gross profit

(1,572)

2,307

Other operating income

1,387

711

Distribution expenses

(558)

(650)

Administrative expenses

(2,134)

(1,958)

Other operating expenses

(1,799)

(630)

Earnings before interest and income tax

(4,675)

(220)

Financial expenses

(38)

(39)

Profit before income tax

(4,713)

(259)

MYTILINEOS GROUP

(Amounts in thousands

€

)

31/12/2015

31/12/2014

Commitments from construction contracts

Value of pending construction contracts

1,190,714

1,292,605

Granted guarantees of good performance

351,041

340,310

Total

1,541,755

1,632,915

4.24 Cash flows from operating activities

4.25 Discontinued Operations

The Group, since 2009, applies IFRS 5 “Non-current assets held for sale & discontinued operations”, and presents separately the assets

and liabilities of the subsidiary company SOMETRA S.A., following the suspension of the production activity of the Zinc-Lead production

plant in Romania, and presents also the amounts recognized in the income statement separately from continuing operations. Given the

global economic recession, there were no feasible scenarios for the alternative utilization of the aforementioned financial assets.

Consequently, from 2011 and on, by applying par. 13 of IFRS 5 “Non-current assets Held for Sale”, the Zinc-Lead production ceases to be

an asset held for sale and is considered as an asset to be abandoned. The assets of the disposal group to be abandoned are presented

within the continuing operations while the results as discontinued operations.

In December 2015, SOMETRA S.A., contributed the Zinc-Lead activity, through a spin – off process, to its newly established subsidiary Rey-

com Recycling S.A. (REYCOM). The said spin - off is part of the “Mytilineos Group” restructuring process, regarding the Zinc-Lead discon-

tinued operation, targeting on the production of Zn & Pb oxides through the development of a recycling operation of metallurgical residues.

Following the analysis of the profit and loss of the discontinued operations:

4.26 Encumbrances

Group’s assets are pledged for an amount of 499,8 m as bank debt collateral.

4.27 Commitments

Group’s commitments due to construction contracts and finance lease are as follows: